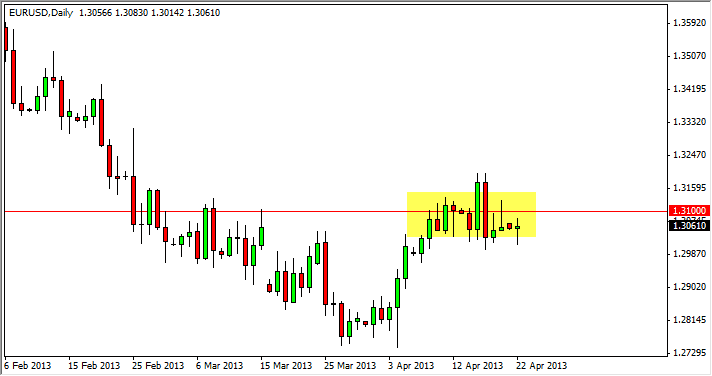

The EUR/USD pair fell during the Monday session, piercing the 1.30 handle for a moment. However, by the end of the session we bounced enough to form a hammer, and this of course means more confusion. When you look at the Friday candle it's a shooting star. When you look at the Thursday candle, it's a shooting star. Wednesday was a complete reversal of Tuesday, and on and on.

This pair is quite frankly one of the more dangerous trades right now, simply because one errant headline and the next thing you know it tanks. Looking forward, I believe that this pair will grind sideways in a relatively tight range over the next several sessions, focusing mainly on the 1.31 handle. It would take a significant close below the 1.30 handle in order for me to start shorting this pair, and quite frankly if I see the Euro lose strength I will look to sell it against other currencies first.

I can't be bothered with it

In what I see this currency do over the last year or so, I'm very quick to ignore the pair, or least just use it for direction only. I have not placed a trade in this pair in what seems like ages, because quite frankly there have been easier trades to be had. Unfortunately, most Forex traders are raised to learn on this particular pair. It doesn't matter that the spread is two pips or less when the market simply chop back and forth.

Ironically, I have learned over the years and most the time the real profits are to be made in markets that most people aren't paying attention to. As this pair tends to grab most of the headlines, a lot of people have completely ignored the GBP/CHF pair. Or how about the great run we have seen in the USD/MXN pair? In other words, don't get too hung up on this pair is quite frankly it's looking choppy, and I see absolutely nothing that's going to change at any time soon.