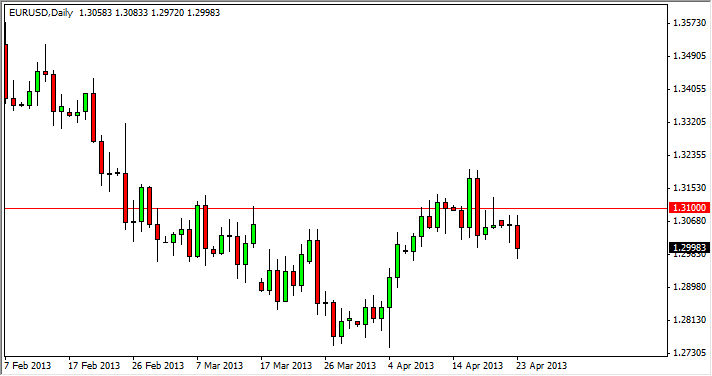

The EUR/USD pair is a great place to lose money these days. In fact, many of the professional traders that I speak to on a daily basis are simply avoiding it. However, having said that it does look like we have seen a little bit more of a weak turnover the last 24 hours in this marketplace. The biggest problem of course is that there are so many minor support levels below that although the market appears to be rolling over, so this is going to be a choppy trade barring some type of negative headline out of Europe.

And therein lies the problem: this pair has been trading on emotion more than anything else recently. Looking at this chart, I can make an argument for support at the 1.2950 level, the 1.29 level, the 1.2850 level, and the 1.28 handle. That's the biggest issue that I have with this pair right now: we simply do not have enough room to move cleanly. The only way we're going to do so is if there some type of shock to the system.

Want to trade the Euro? Try it against a different currency.

Unfortunately, many traders start out with the Forex markets using this pair as their mainstay. This is basically because they are attracted to the small spread, and as a result they are naturally attracted to it. However, by simply adding another pip or two, you can trade several different currencies against the Euro. I feel that a lot of people are shortchanging themselves by messing around with this market that has been so choppy.

It's not that none of my professional trading friends will trade this pair; it's simply that they don't find it that interesting right now. Remember, when you're trading the Forex market you aren't necessarily trading anything. You are simply speculating on the movement of two different currencies, it's not like they're going to show up and deliver Euros to your house. You get paid in whatever your base currency is, so quite frankly it should matter what currency pair you are trading. After all, every trade I've ever placed has come back in US dollars.