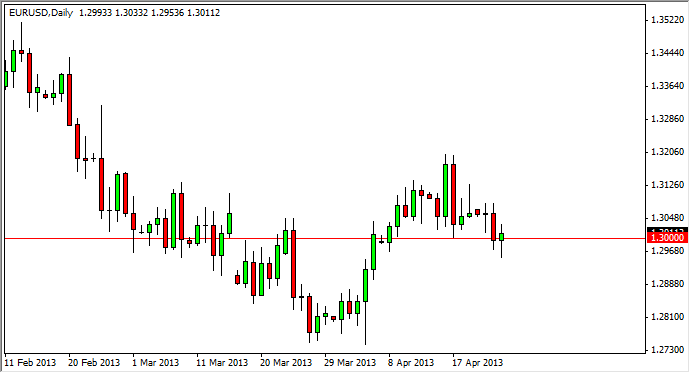

The EUR/USD pair fell during most of the session on Wednesday, but as you can see the bullishness that came into the market that the Euro was pushed above the 1.30 handle. The resulting candle is a hammer, and although I do not like the Euro in general, I have to admit that this market looks like it wants the bounce from here. If that's the case, we then have to wonder whether or not it is going to be significant bounce, or simply a return to the previous consolidation.

Far as I'm concerned, is probably the latter of the two options. I see nothing that makes the market want to go into the Euro hand over fist, but then again I see nothing out there that makes the market want to sell off at this moment either. The concerns about Europe have basically receded yet again, but as you know we have simply been going back and forth with all that, and it seems like every time that all of the fires are put out, another one pops up. This is my base case, and I do believe it will happen again.

Consolidation, and possibly the summer slowdown

This consolidation area between the 1.30 and the 1.32 levels will more than likely contain this market for the short term. However, I do recognize the fact that we are coming close to the month of May, which of course means that a lot of traders will go away for the summertime. Although it doesn't always happen, as a general rule the markets do tend to slowdown once we get that month of May, as traders will simply go away on summer vacation. If that's the case, we could be trying to form the general range that this pair trades during the summer months, granted to have a breakout from time to time but this pair does tend to have a "fulcrum" that it gravitates around during those months. As far as I'm concerned, we need to see a significant break in one direction or the other to get involved in this pair for anything longer than a short-term trade, much like this potential long been formed right now that could be good for 100 pips or so.