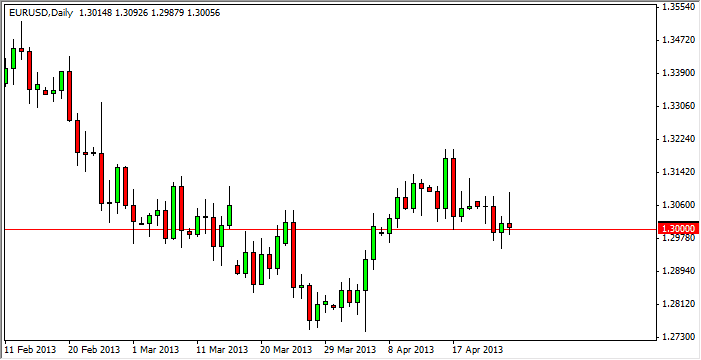

The EUR/USD pair initially rallied during the session on Thursday, but as you can see struggle that the 1.31 handle yet again. The pushback that we saw during the session formed a shooting star that is sitting right at the 1.30 handle, and this does look like a market that's trying to grind its way lower. However, the previous candle was a hammer, so in the end this suggests more confusion than anything else.

With that being the case, I will continue to be out of this market, as I simply have no time for this type of behavior. However, most Forex traders do feel the need trade this pair and I believe that many of them are losing money from the conversations that I'm having. Looking at this chart, it simply a matter of trading between the 1.30 handle and the 1.31 handle. In other words, you can only trade this market very short-term, but I have to say that after the Thursday action, I would have more of a negative bias than anything else at this point in time.

1.29

If we managed to break down below the 1.29 handle, I think this would lead to more selling. Essentially, you want to break down below the bottom of the hammer that was formed on Wednesday, which of course shows support giving way. If that happens, we could quite easily find ourselves down at the 1.28 handle, but in the end I think that there is plenty of noise below that will keep this move from being very clean.

If you feel the need to short the Euro, there are many other currencies out there that you may need to be looking at. The Euro tends to move in tandem against most currencies, so be interesting to see what happens here. For the most part, I've been using this particular currency pair as a barometer of sorts for the Euro, and trading it against other currencies. This is essentially what I've been doing all year, with very little trading to be done in this pair. As you can see, even though we have had a couple of reasonable swings this year so far, they’ve been very choppy overall. With that being the case, I continue to be on the sidelines.