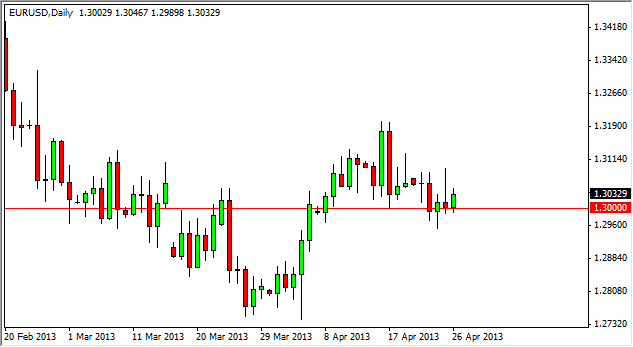

The EUR/USD pair gained during the Friday session, but as you can see it just bounced enough to show the 1.30 level as being supportive. However, this isn't exactly a surprise as we've seen support here over and over now. The biggest problem is that we also see resistance at the 1.31 area time after time as well. So, having said that, I find that this market is completely dead at the moment.

I'm not sure for trying to come up with some type of summer range or not right now, but it does appear that this market simply doesn't have a direction at the moment. Essentially, we are grinding away between the 1.30 level on the bottom, and the 1.32 level at the extreme top. With that being the case, I also see that there is a lot of choppiness between here and there, and as a result I am not overly interested in this pair of the moment.

Which side of the Atlantic has more problems?

The above question is essentially what's driving this market at all times. There are plenty of reasons to be concerned about Europe, not the least of which is a debt crisis that has not been properly addressed. There are also problems such as unemployment in the country of Spain being about 27%, and the Italian Parliament not been able to come up with some type of governing coalition. With all that being said, the Euro has one ace up its sleeve: the Federal Reserve.

The Federal Reserve continues to expand monetary policy, or at the very least keep it flowing wide open. With that being the case, this devalues the US dollar on the whole, and it cannot properly gain against the Euro as it should be doing now. As long as the Federal Reserve continues the metal in the currency markets via bond purchases, this will more than likely be a pair that cannot fall as much is it should. However, there is talk of an ECB rate cut coming soon, but I have a hard time believing that the rate cut will shock the market enough to make it more than a knee-jerk reaction. I believe we are essentially stuck in the moment, and until we can break below the 1.28 level, I am not shorting this market. On the upside, I need to see the 1.31 level to start thinking about buying.