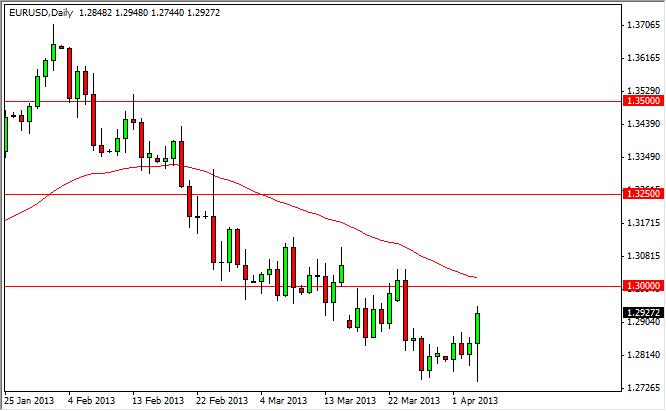

The EUR/USD pair had an interesting session on Thursday as the ECB had its monetary policy meeting for the month. Because of this, this day was always going to be somewhat choppy, but I have to admit I am somewhat surprised by the basing action that we are starting to see. At the beginning of the session, the Euro continued to lose momentum and fall through the 1.2730 level. However, by the end of the day we sell the euro going up to 1.2930 or so, after it became apparent that the European Central Bank isn't prepared to do anything to weaken the currency.

That being the case, the Euro of course did appreciate in value over the course of the day. They got a bit of a bump from the EUR/GBP pair as well, that of course formed a nasty looking hammer itself. Within this chart, this is a bit of an ugly hammer, but it suggests that the 1.27 level will indeed be very difficult to break down through. I always thought that anyway, so this is a much of a surprise to be honest.

I do have to admit that I'm surprised how quickly returned around, but of course was helped by the central banks actions, or rather inaction. Going forward though, I believe that there are plenty of reasons to think that this rally will be short-lived.

Confluence of resistance

Looking at this chart, you can see that the 50 day exponential moving averages plotted on it. This exponential moving average has worked quite well as both support and resistance over the last couple of quarters, and it appears that we are approaching that level now. With that being the case, I think that any rally will be short-lived. On top of that, I can also see that there is a bit of a trend line that we are getting ready to start bumping up against. In a downtrend like the one we've seen recently, it makes sense that the trend line should hold.

However, we have nonfarm payroll coming out today, and it is possible that anything can happen. I still believe that the 1.30 level will be resistive, and all the way up to the 1.31 handle. I think that any rally based upon the knee-jerk reaction of nonfarm payroll will more than likely present a nice selling opportunity if you're patient enough. Alternately, I would be very quick to sell this market under the 1.27 handle.