The EUR/USD pair rose during the session on Friday as the US jobs numbers came out less than expected. In fact, the United States added roughly 1/2 of what was anticipated, and as a result the US dollar got sold off during the session. Nonetheless, this market is still one that could be fraught with a lot of problems going ahead.

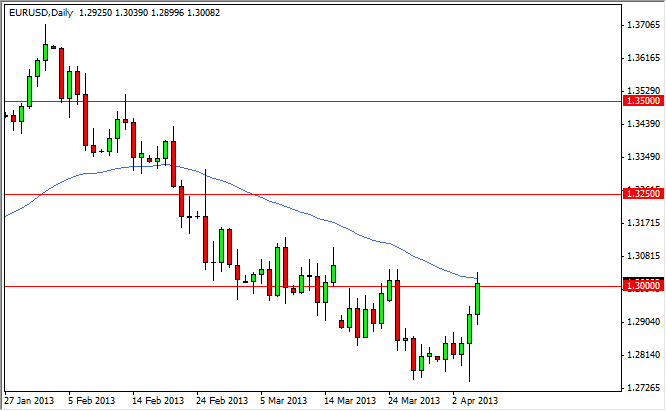

The 1.30 level has been one that I've been interested in looking at or a potential short position for some time. This area lines up nicely with the 50 day exponential moving averages shown on the chart, and the gap formed a couple of weeks ago. Although that gap has been filled, it still hasn't been broken decisively, and that is somewhat telling at the moment.

Also, you have to remember that the European Union is far from being the place where people want to put their money right now. After all, there is a lot of suspicion about the banking system in Europe now that the situation in Cyprus has calmed down. The fact that the idea of punishing the depositors came out will continue to hinder and the road confidence in the peripheral banks. Adding to that confusion, you have the political situation in Italy which hasn't gotten any better, and quite frankly is probably gotten worse. We still have no governing coalition in that country, and it looks like we are heading back to the elections soon.

Looking for a resistive candle

I personally think that we are in the area of that one would want to see and expect to see a resistive candle. Because of this, I am not going to hesitate to sell this market somewhere in this general vicinity, as I do believe that this recent pullback has been a bit overdone. However, it has to be stated that the Euro has a long history of being over exuberant and a bit of a perma-bull attitude can always be found. This pair should continue to be choppy to say the least, and of course headlines will continue to throw around like a rag doll.