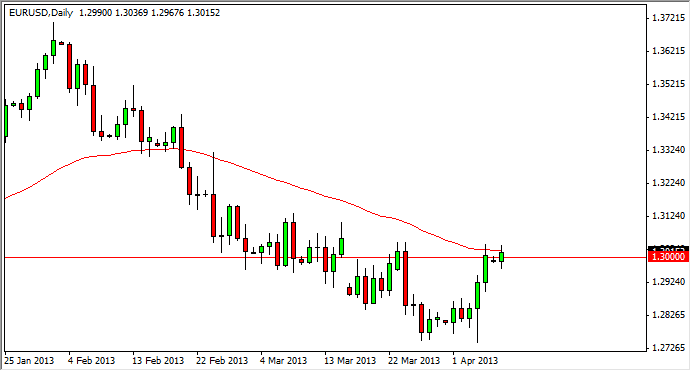

The EUR/USD pair stalled a bit during the session on Monday, essentially going nowhere. We hovered around the 1.30 level, an area that I suspect it would be resistive yet again, which of course proved to be so during the session. Real question of course now is whether or not it continues to be. On this chart, I have the 50 day exponential moving average plotted, and you can see this at the top of the Monday range.

Because of this, I believe that this market will more than likely pullback. However, I am not willing to sell this market until we break the bottom of the Monday session lows. If we have been move, I believe we could see a relatively significant pullback, but at the same time I can make the case for a simple pullback, not some type of meltdown.

With the European Union being and somewhat disarray when it comes to the debt markets, not to mention the banking system, I believe that this pair will continue to have pressure upon it going forward. Even if we break higher, I think that this market will be prone to negative headlines still, and as a result I think that rallies will more than likely end up being selling opportunities before it's all said and done.

1.31

Looking to the 1.31 level, I believe this is a "pivot point" of sorts for the marketplace. If we can close on the daily chart above that level, at that point time I would be comfortable buying again, and probably aiming for somewhere in the neighborhood of 1.33 in the short term. However, I believe that any type of resistive candle is a signal to get out of the market if you are long of the Euro. With that being said, I think that any long position I put on will more than likely be short-lived at best.

If we managed to selloff and below the Monday lows, I believe we will more than likely see a return to the 1.2850 level in the short term. Ultimately, the real support is down to the 1.27 level, but as we are getting fairly close to the warmer months of the year, I begin to question whether or not there are still large moves left before fall.