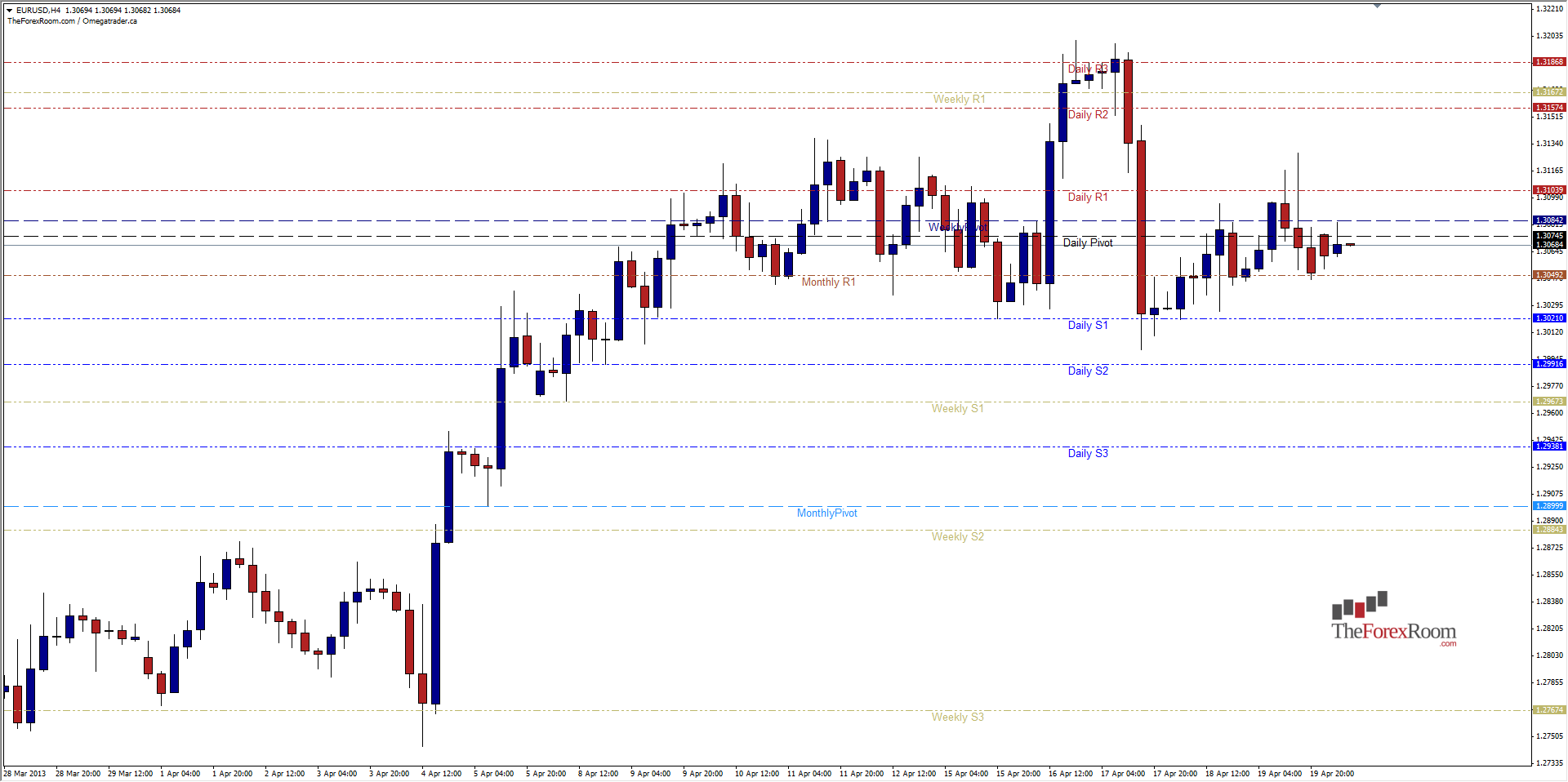

After a wild week for the EUR/USD last week we can now look back and see some method to the madness, or at least a potential way to trade this roller coaster. The EUR/USD started the week by breaking the previous week's low, and I am sure more than a few traders went short at this point since this was at a key support/resistance area at 1.3100. The next day we saw the pair suddenly climb to 1.3201 and then reverse all over again the next day to make a new low once again! If we switch now to a 4 hour chart, we can see a very pronounced Bearish Head & Shoulder pattern with the left shoulder made up of price action of the 11th & 12th of April, the head made up of the violent swings both up and down on the 13th and 14th, and finally the right shoulder being formed by last Thursday & Friday's price action. What this now suggests is that we are heading lower, and when compared to price action on other pairs like the GBP/USD and AUD/USD that both appear to be heading lower, the correlation is strong and makes a good argument for selling. Cautions traders will be looking to enter after price closes below support at 1.3020 (Daily S1) and will encounter further support from 1.2990 (Daily S2), 1.2967 (Weekly S1) and 1.2938 (Daily S3/highs of April 04). The most likely target is really the highs from April 02 at 1.2877 with 1.2770 as the ultimate target in the near term. Resistance still sits above at last week's shoulder highs of 1.3130-1.3140 and weekly highs at 1.3201. If prices head higher from here, only a daily close above 1.3201 will confirm a Bullish continuation to the 1.3284 or 1.3430 levels of resistance.

EUR/USD: Head & Shoulders

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/USD