By: Jonathan Miller

With today’s reopening of the Cyprus Stock Exchange, the problems of the Island Nation have largely been forgotten by markets as the focus shifts back to Italy and Spain which are prevailing source of weakness in the Eurozone. PMI data out this morning further confirmed the broader manufacturing retrenchment across the economic union as even economic stalwart Germany showed a minor contraction.

Furthermore, this week will see an interest rate decision from the ECB. While traders have been raising expectations of an imminent rate cut, with the Euro at present levels, the ECB might use this as a tool down the road, likely avoiding cutting rates at this meeting. This could possibly fuel upside in the pair as policy remains unchanged and inflation is largely contained.

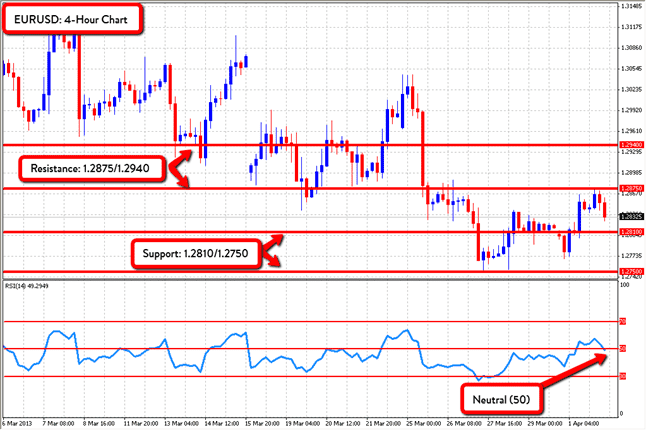

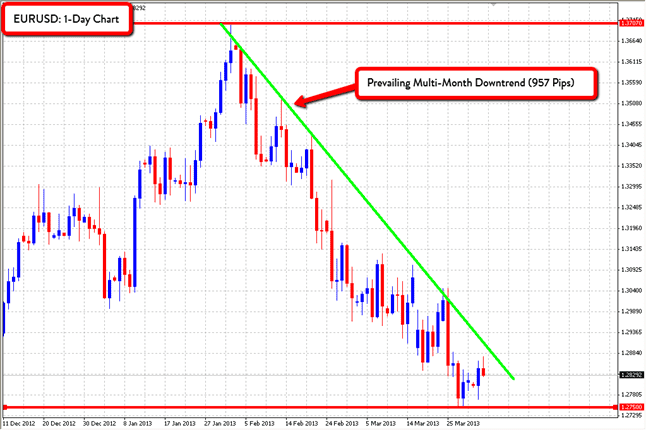

After touching lows not seen since November, EURUSD has rebounded substantially from 1.2750 and considering the multi-month downtrend with no visible technical pullback, the pair might be setting up for a retrace of the recent move lower after bouncing over 100 pips off of multi-month lows. Typically we look for between a 30-60% pullback based on a directional move, and considering the lack of such an occurrence, the likelihood of sharp pullback is increasing. The failure yesterday to break to new lows also could boost speculation that the pair will advance. Short-term resistance is sitting at 1.2875 and higher at 1.2940 while support holds at 1.2810 and 1.2750 and he RSI is left clutching to the neutral area.