For the previous week, the Euro rose to an eight-week high before later crashing and ending the week lower. Italy’s inability to form a government since February’s election cliffhanger is one major reason. However, Italian President Giorgio Napolitano was returned to the office for a record 7th consecutive term after he was persuaded to vie for the office against his earlier wish. This development may turn out to be positive news if he is able to assemble a government coalition within the shortest period.

Greece which had been Europe’s sore thumb for the past few years was compounded by fresh financial woes in Cyprus. Even Europe’s giant - Germany also had a dose of bad news that week with ZEW economic sentiment dropping heavily and it’s obvious that the bad situations keep getting worse for the continent.

On Friday, ECB’s Jens Weidemann spoke about a possible rate cut if things don’t improve. “We didn’t change interest rates at our last meeting as they are currently appropriate and in accordance with our assessment of economic developments,” Weidmann says. However, he added that “we shouldn’t expect too much” from a possible rate cut because “monetary policy will not be able to solve structural problems in the euro area.”

In the US, recent data weakness indicates that fiscal discipline is gradually squeezing economic growth especially with the disappointing jobs data for March, ISM manufacturing index and retail sales numbers. The labor stats for April is expected to be better though as these reports will be used by FOMC’s members to decide on the size and duration of its asset purchase policy.

This week, durable goods orders, unemployment claims and 1st quarter GDP featuring an estimated 3% economic growth are being expected.

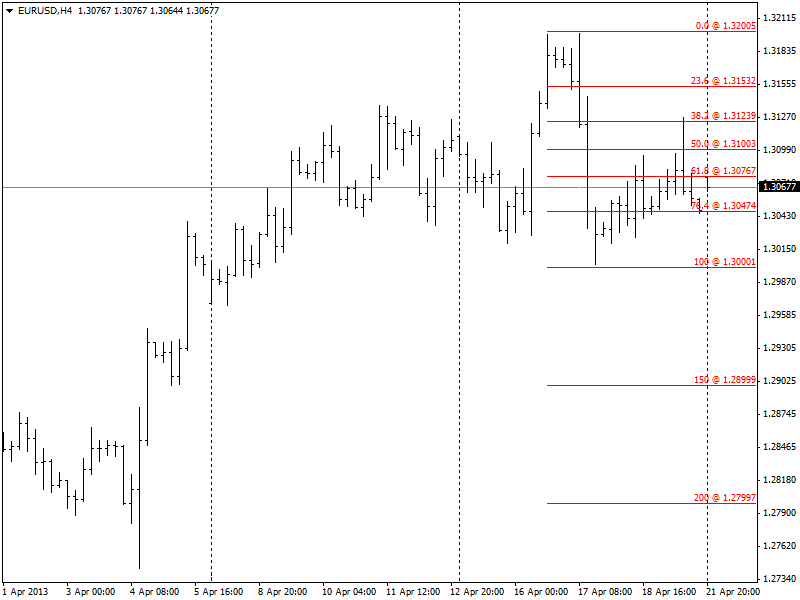

Therefore, sell EURUSD below 1.30 towards 1.29 or buy above 1.32 and exit at 1.33.