CurrencyShares Japanese Yen Trust (NYSEARCA: FXY) pushed higher on April 26, 13 to 100.12 after news of latest inflation figures from Japan. The trust remains at a -2.66% level below its 50 day moving average and +2% above its 52-week low.

The Japanese CPI dropped further to -0.08% compared to -0.07% in February signaling deflationary movements, despite Shinzo Abe’s goal to inflate through monetary easing. Bank of Japan had forecasted an increase of +0.9% in prices by 2014 but new data from Reuters poll argued that percentage to be near +0.5% instead. Current sentiment in the market still persists that BOJ’s new policies will bring forth inflation to supplement the country’s net exports – resulting in a weaker yen compared to the dollar. Hence, making the sudden rise in FXY a prime opportunity to set up a short for the long run.

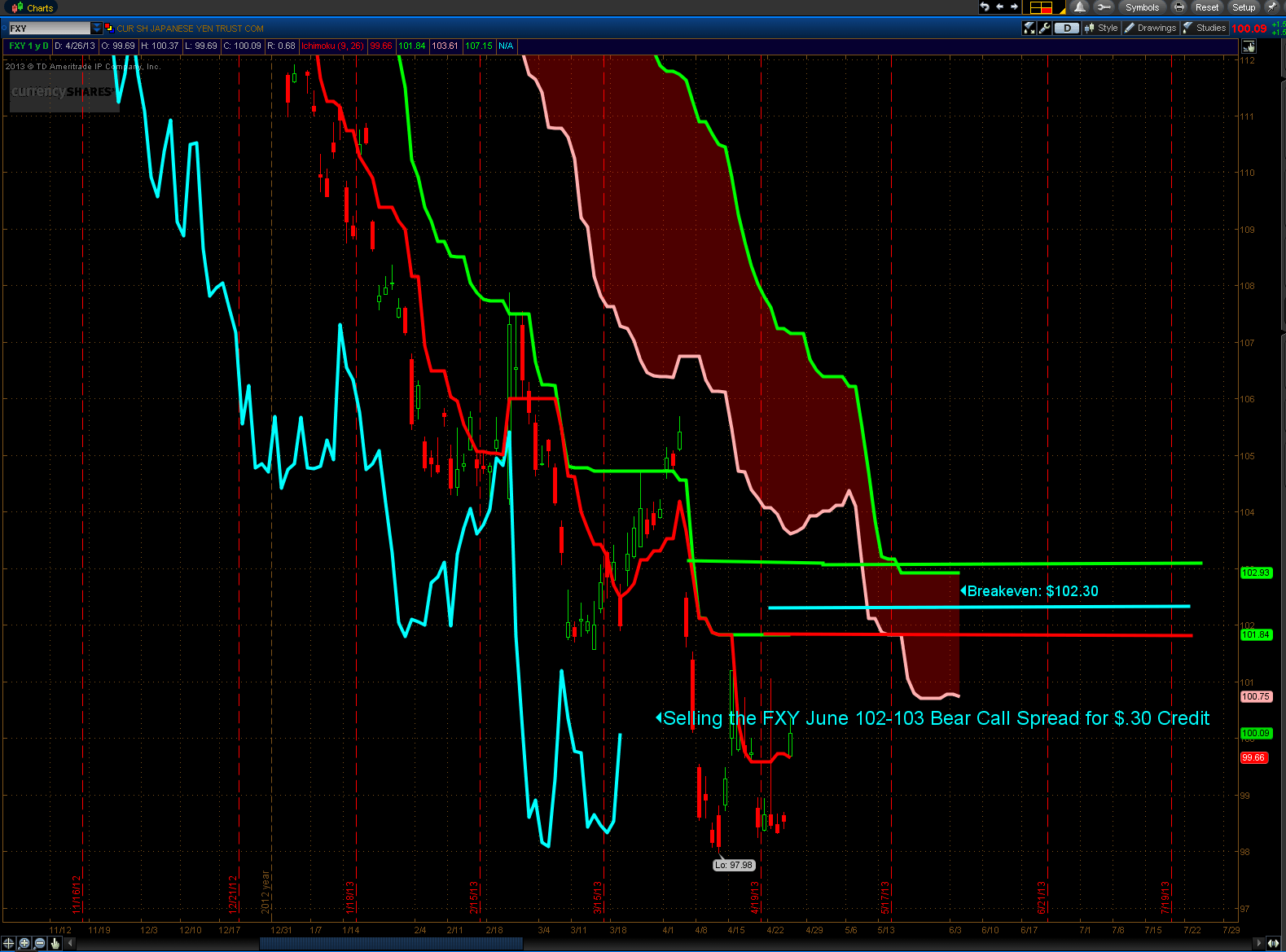

FXY looks breaking through the first level of Resistance on the Ichimoku Cloud on the 9 Period Moving Average at $99.60, but there should be more headwind at $102, the 26 Period Moving Average.

My Trade: Selling the FXY June 102-103 Bear Call Spread for $.30 Credit

Risk: $70 per 1 lot

Reward: $30 per 1 lot

Breakeven: $102.30

I like this trade, because I make money if the FXY is flat, goes lower, or rallies less than 2% between now and June expiration.