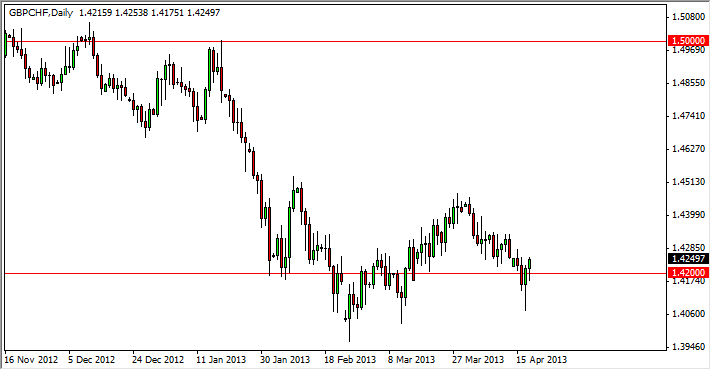

The GBP/CHF pair had an interesting session on Thursday, breaking above the top of the hammer that was formed on Wednesday. With even more interesting is that this all happened of the 1.42 handle, an area that has been supportive and resistance in the past. This now looks very interesting to me because of the fact that we have broken the top of the hammer, and the fact that we could be starting to see a little bit of a trend reversal at this point.

Looking at this chart, I cannot help but think about the GBP/USD pair as well. It is currently bouncing off of a fairly significant support line also, which of course can lead to British pound strength overall. On top of that, there are many of the Swiss franc related pairs that look similar this point as well. This could in fact be an anti-franc move more than a pro-pound move.

I am not sure that this is going to be some kind of massive move, but a move back to the 1.45 level gets very interesting because then all of a sudden we could be talking about an inverted head and shoulders. I see that we have stair steps going down just above us, so this could produce a bit of choppiness on the way back up. However, I think the risk to reward ratio certainly there.

Countertrend

The one thing you have to remember in the meantime is that although we have formed a nice hammer at the 1.42 handle, this is an overly countertrend trade. With that being the case, stop losses are vital, and they should be used in a fairly tight manner. I will certainly be very careful using line, and I would highly recommend the same for you. Going forward, I could see a couple hundred pips in this trade fairly quick. However, I am not married to this position and I think that choppiness could continue as well. With this being the case, I am going to be fairly quick to take profits.