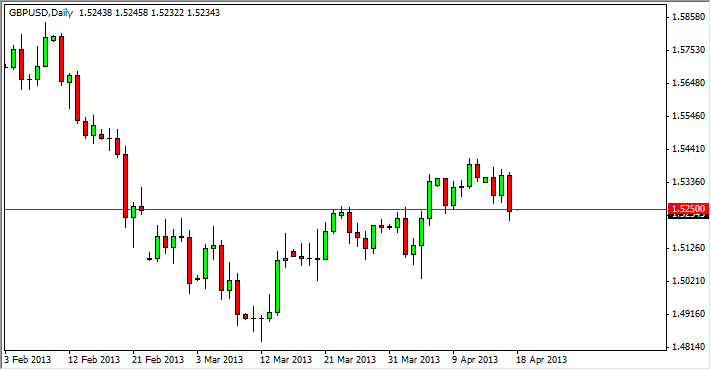

The GBP/USD pair had a negative session on Wednesday, piercing the 1.5250 support level, albeit for just a brief moment or two. Nonetheless, it does appear that we have made a serious attack on the support, and it seems that this market could very easily drop from this level. There is a lot of fear in the marketplace right now, so it's probably only a matter of a negative headline to get this market to start falling apart.

The US Dollar looks very strong right now, and this is especially true in the US Dollar Index. With that being the case, I am a bit hesitant to sell the Dollar in general, but this is an area that I would expect to see some type of supportive. Because of this, I am willing to take the long position if it presents itself, but it would have to be based upon a daily candle, and not some short-term chart.

1.5250 is vital

The 1.5250 level is a significant area on this chart. In fact, I think it will determine the next 200 pips or so in this marketplace, and paying attention to this area is exactly the way that a professional trader will make their decision. It appears to me that there is a serious chance of weakness, but again I would need to see a break of the low from the Wednesday session, and perhaps even a four-hour close below the 1.52 handle in order to start selling. Alternately, if I were to buy this pair would have to be on a nice daily candle, perhaps a hammer right at current levels.

The Bank of England is expected to engage in monetary policy expansion over the summer, and I believe that it is possible we are starting to see that somewhat priced then. Nonetheless, the world runs to the Dollar when times are tough, and there are certainly plenty of things to be worried about right now. With that being the case, if I were a betting man I would suspect that I will be selling this pair sometime tomorrow.