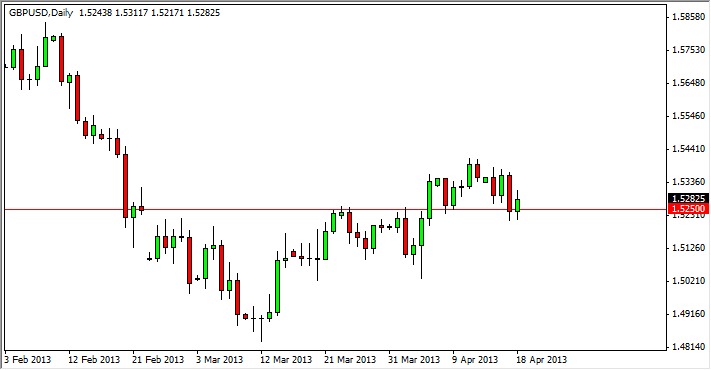

The GBP/USD pair bounced off of the 1.5250 level for the Thursday session, but did give back some of its gains. The pair previously had significant resistance at that level, so the fact that it's acting like support now should be much of a surprise. In fact, there was a gap that formed just below this area in late February, which should now be very supportive.

Going forward, I believe that the British pound has only a certain amount of positive weeks ahead of it. This is mainly because the new Gov. of the Bank of England is coming in July, Mr. Mark Carney, who is the head of the Bank of Canada at the moment. He has already stated more than once that monetary policy in the United Kingdom will have to be expanded. In other words, quantitative easing.

That being the case, the Pound certainly will depreciate in value against the US dollar, as well as many other currencies. With that being the case, I think that eventually there will be some type of downward pressure in this pair, perhaps at the 1.55 level where I see a bit of clustering, that could in fact offer a reasonably enough excuse to start selling.

Channel

Another reason that I think this pair will continue to grind a bit higher for the short term is the fact that we have formed a reasonably healthy looking channel. This uptrend is small in the big scheme of things, but it is very tightly packed in this channel, and very predictable at this point time. This is exactly what traders like to see, and as a result it will become somewhat of a self-fulfilling prophecy.

If we managed get below the 1.5250 handle however, I would start selling. A daily close below the 1.52 level would be enough to get me to start doing so. I think this is more than likely not going to happen, so of course you always have to keep your options open. At that point in time, I would have no interest in buying this pair anymore.