The GBP/USD pair had a strong showing on Friday, especially after the nonfarm payroll numbers came out much weaker than anticipated. Because of this, the US dollar sold off in general, and the British pound would have been one of the beneficiaries. Also, the Bank of England suggested on Thursday that they weren't that fairly that close to doing something as far as monetary policy is concerned. This should have been much of a surprise, after all the new Gov. doesn't come until July, but the markets reacted anyway.

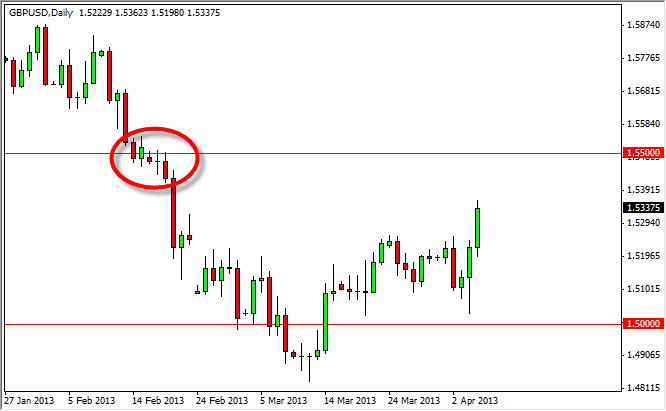

The Bank of England will eventually ease its monetary policy, and the market certainly should know that. With the United Kingdom skirting around the possibility of a triple dip recession; it's only a matter time before the Pound start getting sold off again. Looking at this chart, I believe that we do have a clear path to the 1.55 resistance area, but in reality we should the quite a bit of selling pressure in the general vicinity.

With all that in mind, I am actually flat of this market and waiting to see that resistive candle. I do see the 1.53 area has been somewhat supportive, as there is a former gap in the general vicinity, ADA been so resistive over the last couple of weeks. With that being the case, I do believe that there are plenty of short-term opportunities to start buying the Pound, but I think in the long-term the bullishness wanes.

Shooting stars and other negative signs

Near the 1.55 level, I would like to see a shooting star other negative candle such as a bearish engulfing one. This is a perfect spot to see this type resistance enter the marketplace, and as you can see by the cluster back in the beginning of February, there was a lot of push and pull in this general vicinity. With that being the case, resistance makes sense down here, and as a result I will be looking for that exact type of trade. If we managed to get above the 1.55 level cleanly on a daily close, it is at that point time that would be convinced that this is something more than a pullback.