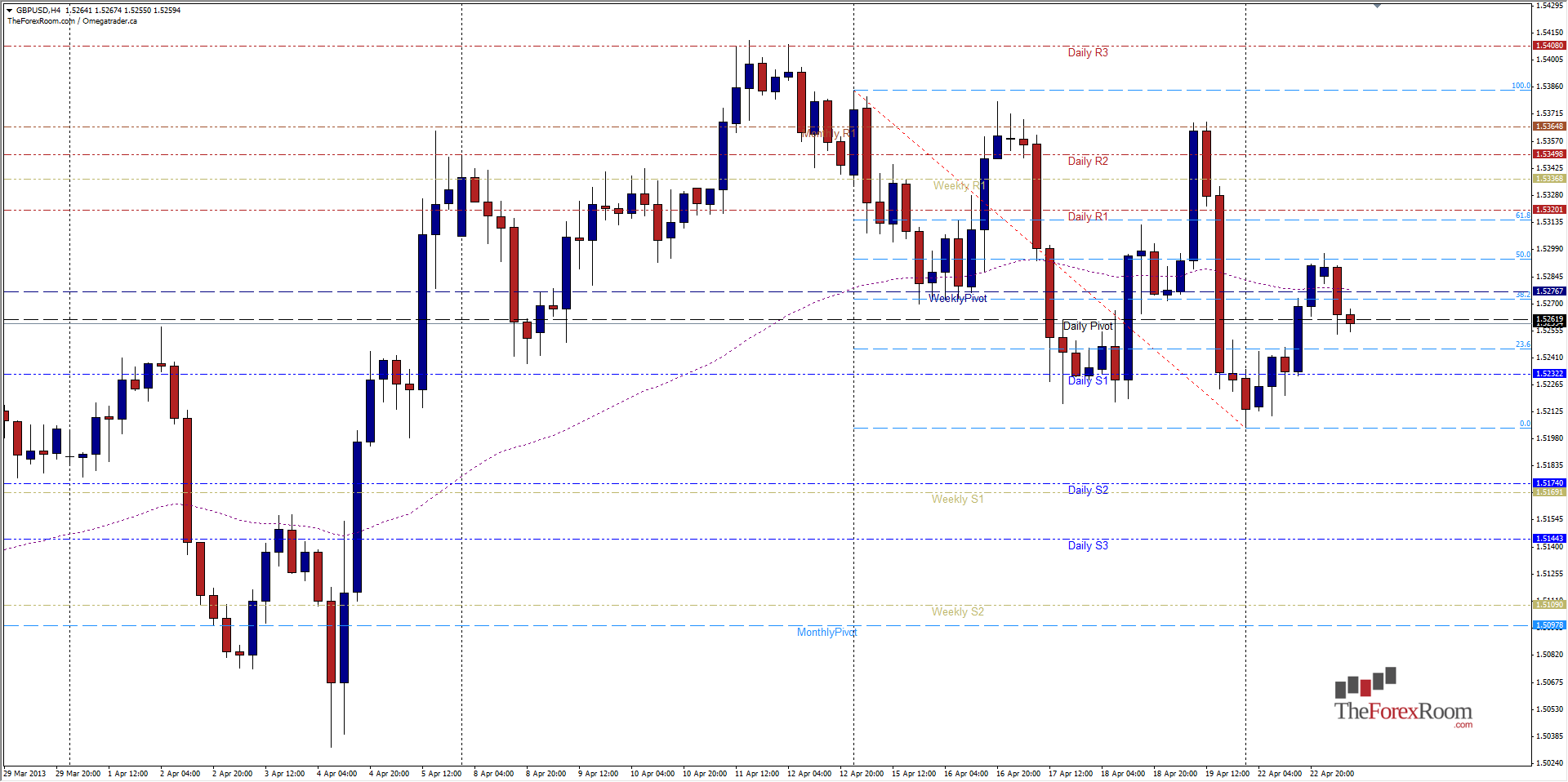

Yesterday was a relatively boring day in the Forex markets, with very few news events or fundamentals and a low volume Monday to top it off, not many of the major pairs moved much one way or the other. That is, with the exception of the GBP/USD which took advantage of the low volume to rise more than 90 pips, exactly 50% of last week's entire range before returning to the current levels of 1.5260. The pair fell early yesterday in the Asian session to a low of 1.5203 before it began ascending to the 50% area, and made a daily high of 1.5297, just shy of the key 1.5300 level. Now it would appear that the pair is going to resume its bearish descent but must clear 1.5200 in order to fall further. 1.5200 marks the highs from the 1st and 4th of April and makes up the Daily S1. 1.5175 is the Weekly S1/Daily S2 and will also offer support in the short term. Big picture this pair looks to be resuming its bearish trend that can be seen on the Weekly Charts very clearly, and will probably head for 1.5000 again in the days ahead. Public sector net borrowing and CBI industrial order expectations are on tap about mid way through the London trading session and new home sales will be on tap from the US session, all of which will have some bearing on this pairs outcome today.

Happy Trading