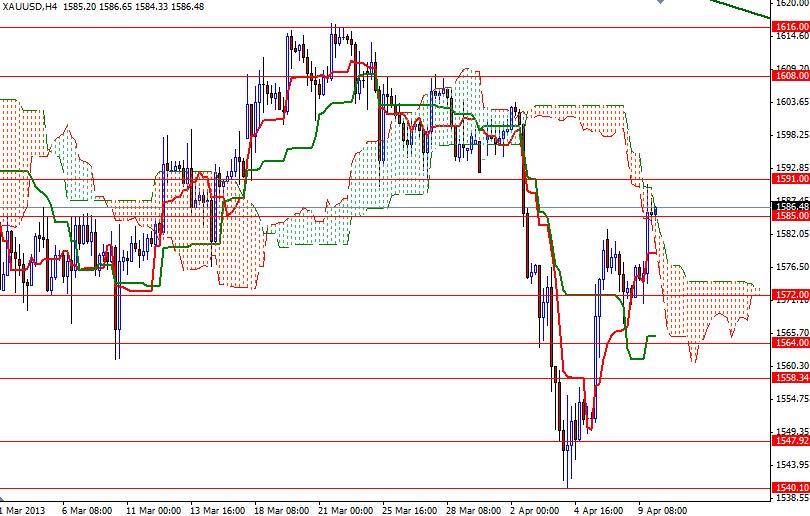

Gold gained some ground against the greenback and covered Monday's losses as mounting tension in the Korea region bolstered the precious metal's safe haven appeal. Gold prices are also supported by growing expectations the central bank of the United States will keep buying assets to hasten economic recovery for the foreseeable future. Although both the daily chart and 4-hour chart are giving mixed signals, trading above the 1585 level suggests that the bulls regained some of their strength. This level was the top of a previous consolidation area which we saw during the first week of March. On the daily time frame, prices remain below the Ichimoku cloud and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses.

However, on the 4-hour chart, the XAU/USD pair is trading above the Ichimoku cloud and we got bullish Tenkan-sen - Kijun-sen crosses. As I mentioned in my previous analysis, it is likely that we will continue to climb for some more time but honestly I don't see any reason to break out of this descending channel which the pair has been running in for weeks. Today market participants will be focusing on the latest Fed policy meeting minutes so the trading action may be tight until the release. If the bullish momentum continues, resistance can be found at 1591, 1598 and 1608. If the pair encounters heavy resistance and reverses, expect to see support at 1580, 1572 and 1564. A close back below 1564 could act as confirmation that the momentum is once again turning bearish.