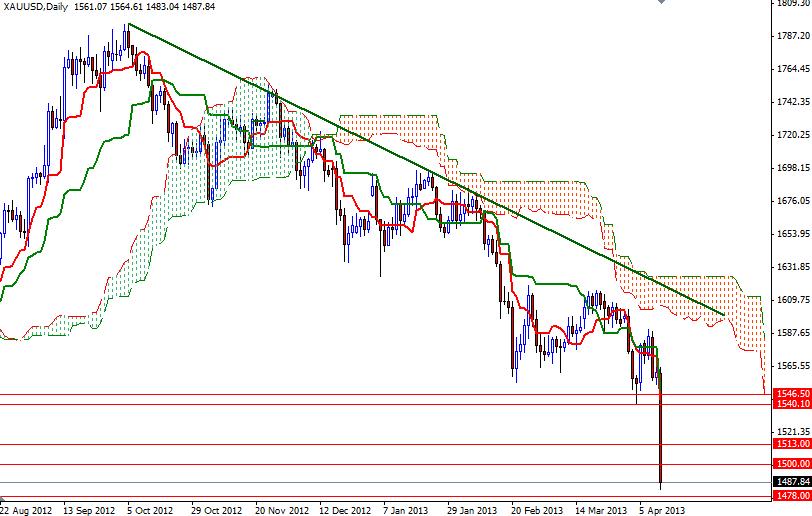

The XAU/USD pair had an interesting week, as prices finally broke below the 1532 support level which was the bottom of a giant consolidation zone. Gold prices had been running in this rectangle more than 80 weeks. As a result, breaking below the support zone that has been holding this market up since September 2011 triggered a sell-off during the Friday session. The pair traded as low as 1480.04, a level not seen since July 1, 2011. Although this is an extremely bearish situation which indicates a major correction might be on its way, it is possible to see a bounce before heading low. Technically speaking, when a strong support (or resistance) line is broken, the market may respond and retest it before continuing the trend. Such pullbacks could provide nice selling opportunities in this market.

If the bears continue to dominate gold prices, based upon the measurements, my short-term target will be the 1446.50 level. On its way down, expect to see some support at 1478 and 1473. In the long run, I think the ultimate goal for the bears will most likely be 1325 and 1266. As for buying, I can't see any technical or fundamental reason to do so. Prices are below the Ichimoku clouds and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) crosses on all time frames. It seems that gold prices will remain under pressure amid expectations the Federal Reserve will end its asset buying program some time this year. If the pair finds support at these levels and turns north, there will be resistance at 1500, 1513 and 1532.50.