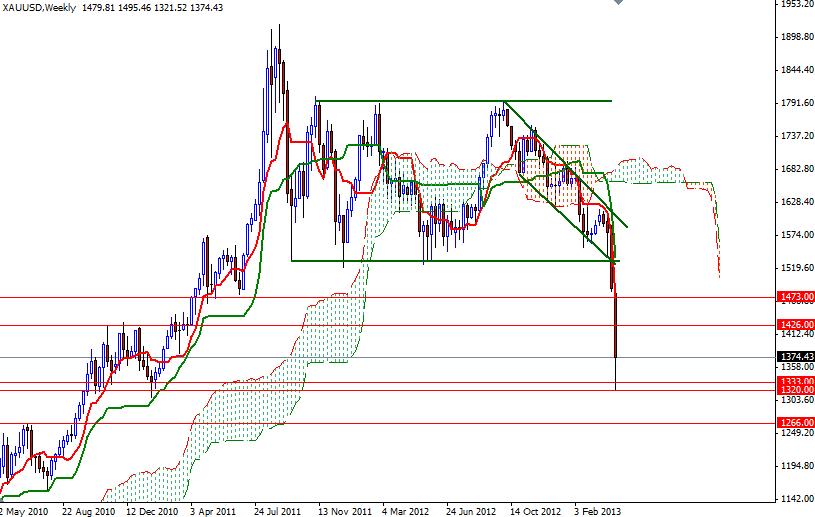

The XAU/USD pair closed higher than opening as market players started taking profits near the 1320 support level as expected. Gold prices hit 1321.52 yesterday, the lowest since January 2011, before bouncing back to the 1403. Right now the pair is trading at 1374.43 and prices are steady during the Asian session today as the adrenalin rush of Monday’s panic move is now wearing off. Considering the fact that the XAU/USD pair has seen suffering from a strengthening American dollar since prices reached the 17 month high at 1795.52 in October 2012, witnessing a retracement around these levels does not seem to be so surprising. If the low prices attract more buyers and therefore help the bulls to defend the 1320 support level, it is entirely possible to see a consolidation between the 1320 and 1426 (which happens to be the Fibonacci 23.6 based on the bearish run from 1795.52 to 1321.52) for some time.

If we can get above the 1426 level, the pair may extend its movement towards 1473 - 1498 (Fibonacci 38.2). From an intra-day trading perspective, breaking above 1381 could signal a run up to 1397 or higher. If that is the case, expect to see more resistance at 1411 and 1426. If the downward pressure continues, the first support zone to watch will be located around 1367-1362. Below this area, support can be found at 1356 and 1348.