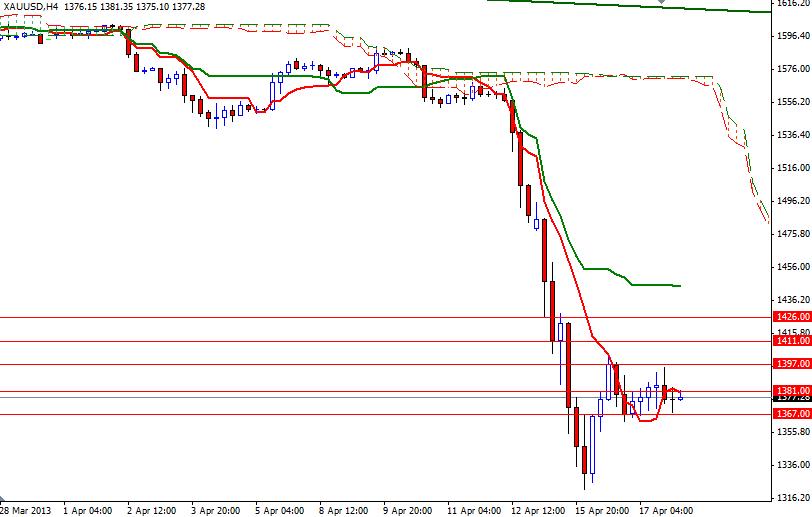

The XAU/USD pair has been range bound since prices bounced off of the 1320 level. Although gold prices advanced two days in a row, we are still trapped in a relatively small range during the Asian session today. For the last 7 months the biggest influence on gold prices has been speculations that the U.S. Federal Reserve will reconsider its quantitative easing program and scale back the pace of the $85 billion/month asset purchases some time this year. Yesterday the Fed’s Beige Book revealed that "Residential and commercial real estate improved markedly and most districts noted increases in manufacturing activity since the previous report". Aside from the improving economic data from the United States, weakening Chinese economy has been weighing on the shiny metal. Since Chinese gold consumption plays an important role in this market, disappointing numbers out of China could increase the downward pressure. Because of that the upside may be limited as investors become more anxious. From a technical point of view, I can't find a reason to buy gold at the moment. On the weekly, daily and 4-hour time frames, prices are well below the Ichimoku cloud and the Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses suggest that the bears are firmly in control.

Today, I will be watching the 1367 - 1397 zone. If we break below 1367, I will be looking for 1347, 1333 and 1320. For now, I see heavy resistance at the 1397 level, so the bulls will have to break through this level in order to gain enough strength to test the next barrier at 1411. Beyond 1411, expect to see heavy resistance at 1426 and 1440.