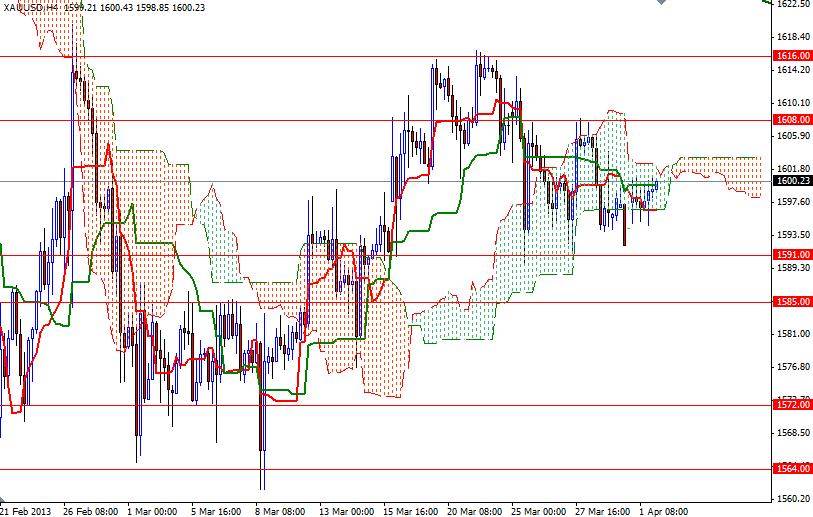

The XAU/USD pair (Gold vs. the American dollar) closed the day higher than opening but the trading range was tight as major European markets were closed for Easter holiday. The demand for gold found some support after weaker than anticipated ISM Manufacturing PMI eased the greenback’s safe-haven appeal. Data released from the Institute for Supply Management showed that the index of national manufacturing activity fell to 51.3 from 54.2. Gold also drew strength from speculations the Federal Reserve will maintain its $85 billion monthly asset purchases to hasten economic recovery. The first week of the month is always a busy one for the major central banks. In addition, several PMI data will be released will be released from key economies around the world over the week as well. While the 4-hour chart shows that there is a descending triangle forming, there are several strong resistances ahead.

If the bulls can push prices above an interim resistance at 1603.50 which happens to be the Tenkan-sen line (nine-period moving average, red line) on the daily time frame, the pair will most likely be heading towards the first barrier at 1608. A daily close above the 1608 level would make me think that the bulls are strong enough to retest last month's high of 1616.71. However, in order to confirm a long-term bullish trend, I believe that a weekly close above 1626 is essential. If the bulls fail and prices drop, I expect to see some support in the 1594-1591 area. Below this area there are two important support levels that I will be closely watching: 1585 and 1580.