The XAU/USD pair advanced towards the critical resistance level at 1444 yesterday as a weaker U.S. dollar lured some investors back to the market. The latest massive gold sell-off was initially ignited by the prospect of slowing Chinese economy, concerns over the Eurozone's debt crisis and speculations that the U.S. Federal Reserve will end its bond buying program sooner than anticipated. A sustained rally in U.S. and Japan stock markets has been another important element. Although there is a growing conviction that the dollar is likely to strengthen, physical demand seems to be strong at this points. However, how long this buying frenzy will continue is a mystery. I think the sudden and steep fall in gold prices indicates a strong technical and fundamental shift in the market.

Because of that, I have no intention of buying gold (for a long-term) until my technical analysis signals that the bears lost their control over the prices. From a short-term perspective, I will be paying attention to the levels I marked on the 4-hour chart. It seems that the XAU/USD pair will continue to wonder around the 1426 before it picks a direction.

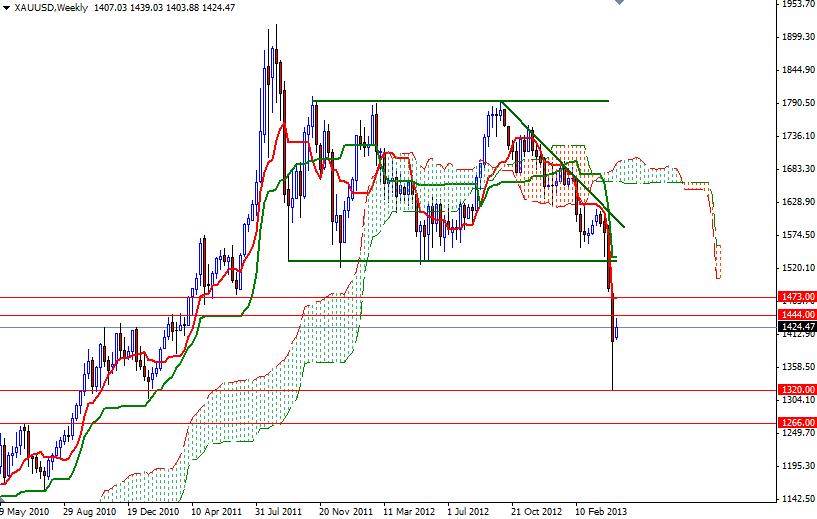

Right now prices entered the Ichimoku clouds and that means the pair will be range bound for some time. Technically speaking, the thicker the Ichimoku cloud, the less likely it is that prices will manage a sustained break through it. In our case, the XAU/USD pair will need to break either above 1555 or below 1398 before it can resume trending. The first resistance ahead of us is located at 1444 and beyond 1555 there is a significant resistance around the 1469/1473 zone. To the downside, there is an interim support at 1411. If gold prices break below that level, the market will probably test the 1398 level which happens to be the upper band of previous consolidation area. A daily close below 1398 would suggest that we might revisit 1386 and 1363.