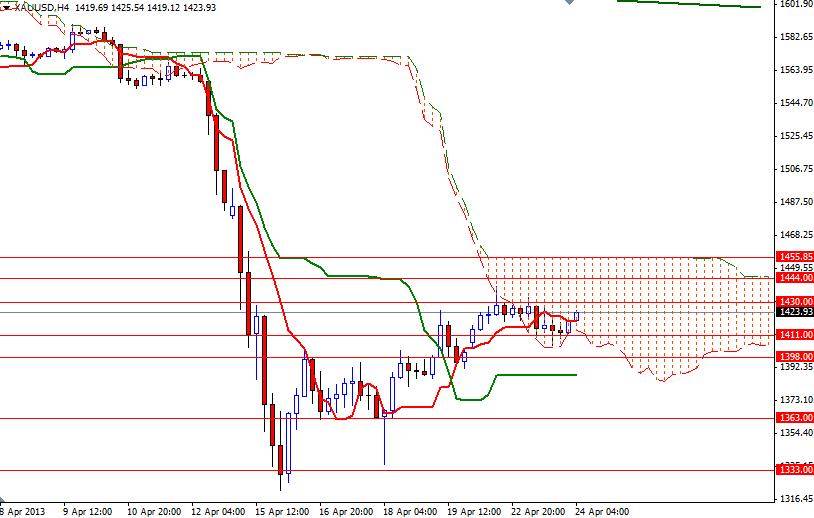

The XAU/USD pair closed Tuesday's session lower than opening after five consecutive days of gains. Investors turned to the relative safety of the American dollar after the PMI data out of China and Eurozone missed expectations. The preliminary HSBC Manufacturing Purchasing Managers’ Index fell to 50.6 from 51.4, boosting concerns over the world's second biggest economy and gold consumer. Data released by Markit showed that economic activity across the 17-nation bloc continued to shrink. Although these reports helped the greenback, the gold bulls managed to keep gold prices within the Ichimoku cloud and also successfully defended the 1411 support level. On the 1-hour time frame the XAU/USD pair climbed above the cloud and the Tenkan-sen line (nine-period moving average, red line) is about to cross above the Kijun-sen line (twenty six-day moving average, green line) but in order to gain a stronger momentum, the bulls have to push prices above the 1430 level. I think a sustained break above this level would give the bulls the extra power they need to visit 1444 and 1455.

A daily close above 1455 could extend this retracement. However, if the bulls encounter heavy resistance and prices reverse, 1411 - 1398 support zone will be the key to the downside. A break below 1398 could act as confirmation that the momentum is once again turning bearish.