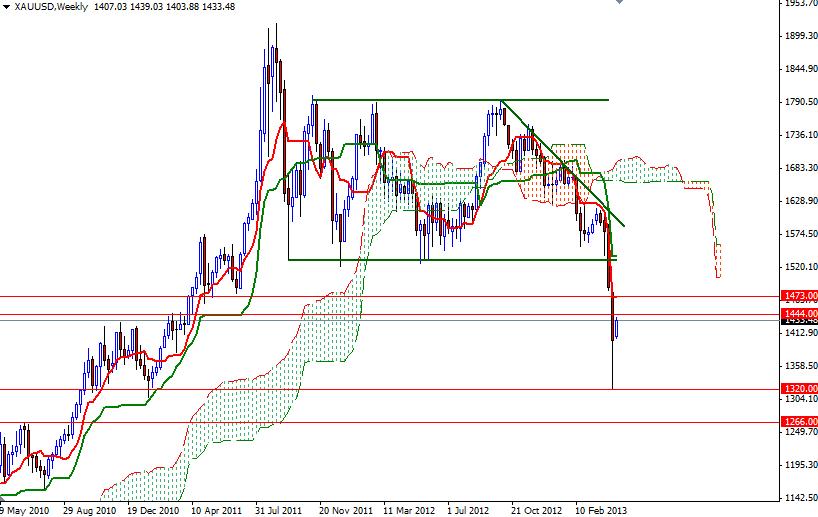

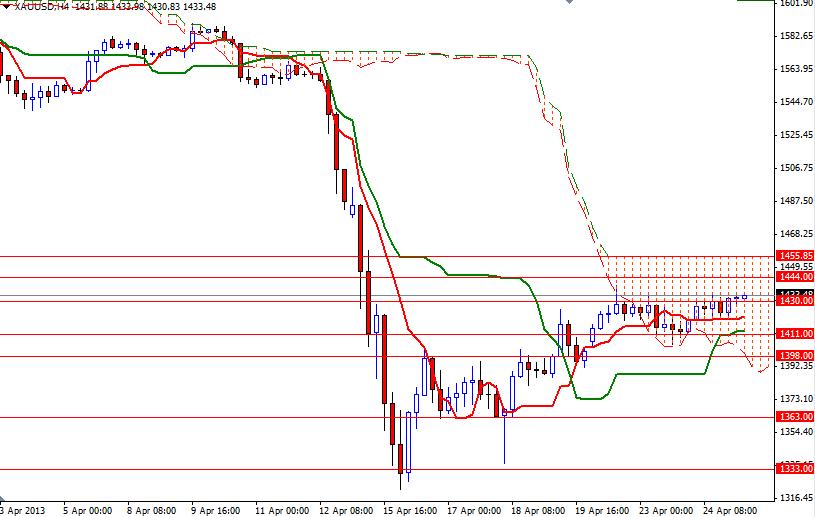

After a temporary pause on Tuesday, gold prices continued to move higher yesterday. The XAU/USD pair managed to break above the 1430 resistance level as the American dollar weakened after the data released by the Commerce Department showed that demand for durable goods slumped in the previous month. According to yesterday's data orders for durable goods fell 5.7%. If economic recovery weakens, then the Federal Reserve wouldn't give any signs of an early withdrawal of quantitative easing at its next policy meeting. It appears that physical demand has been giving the precious metal a psychological boost, but we can't ignore the fact that prices broke below a massive consolidation area. Because of that I think that possibility of a further drop (in the long term) still exists, technically. On the other hand, expecting gold prices to drop all the way back to the 1000 level would not be realistic.

The central banks around the world are looking to increase the proportion of gold in their reserve assets and this can limit the downside because they can be quite significant purchases. In the meantime, shorter-term traders will more than likely enjoy a bullish move towards the 1455 level which happens to be the upper line of the Ichimoku cloud on the 4-hour chart. I believe this will be an important level for a bullish continuation. If the bulls manage to break and hold above this level, they will probably be challenging the bears at 1469/1473. However, if they fail to penetrate the 1444/1455 zone, the XAU/USD pair could reverse and test supports at 1411, 1398 and 1363.