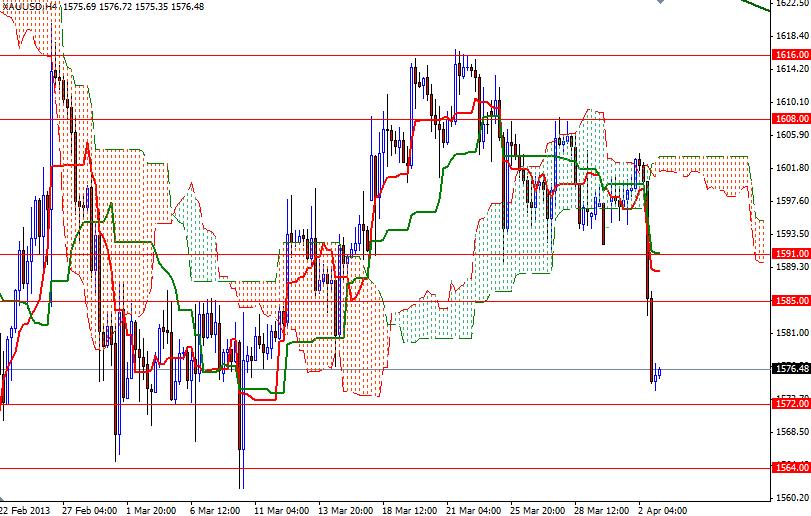

The markets were finally back at full strength yesterday after the Easter holiday around the world. The XAU/USD pair dipped to a low of 1573.85, which happens to be just above the support level of 1572, as investors turned to the relative safety of the U.S. dollar on intensifying worries over ongoing problems in the eurozone. On several occasions I have mentioned that the pair would remain under a strong pressure while trading within the descending channel which we see clearly on the daily time frame. Until the conditions in the market place change (strengthening U.S. economy and heightened appetite for more conventional assets, such as U.S. equities), I believe that the shiny metal will sink deeper. Technically speaking, the overall trend will be dominated by the bears as long as prices continue to move below the Ichimoku cloud on the daily chart.

With this in mind, I think that the 1572 support will be challenged today. If this level gives way, then the 1564 level will be next. A close below this critical support would trigger another sell off which may drag prices down to 1547.92. To the upside, the bulls will need to break and hold above the 1580 - 1585 resistance zone in order to regain some strength. Beyond 1585, expect to see more resistance at 1591 and 1608. Today sees release of important economic reports from the United States such as ADP Non-Farm Employment Change and ISM Non-Manufacturing PMI, so expect volatility.