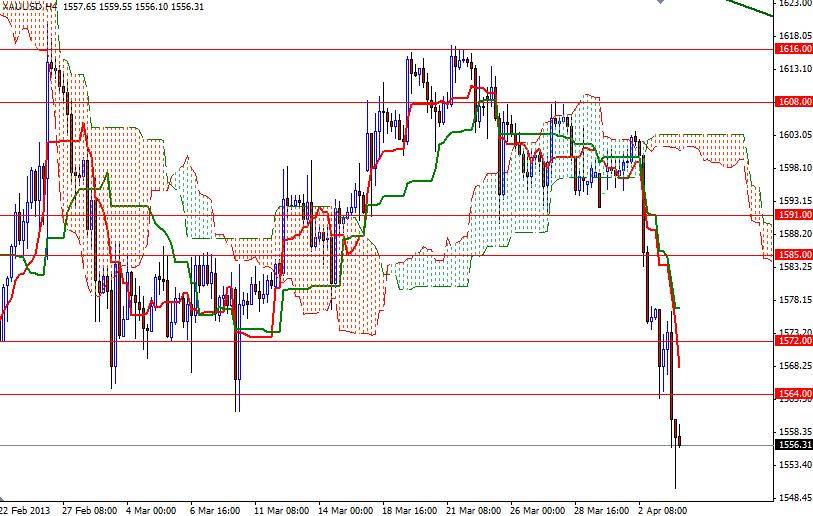

The XAU/USD pair continued to sink yesterday and hit its lowest level since July 2012. Although data released from the Unites States were disappointing, technical selling pressure had a stronger impact on gold prices. The ADP Research Institute said companies added 158K employees in March after a revised 237K gain in the prior month and data released by the Institute for Supply Management revealed that its non-manufacturing index declined to 54.4 from 56. During the Asian session the pair traded 1549.68 before slightly recovering to 1556. Yesterday the 1564 support level was a critical one which will accelerate downward movement. Since we broke below this important level I expect to see prices testing the June 28 low of 1547.92 today. If the bulls successfully push prices below this level, it is possible to see a bearish continuation to the next key support levels of 1532 and 1530. The area is also at the bottom of a massive consolidation zone which prices have been running in for almost 80 weeks. Because of that, I strongly believe that the precious metal's fate will depend on this historical support zone. A weekly close below that level would suggest that a massive selloff is on its way. In that case, I will be looking for 1487 and 1444 in the long run.

As for buying, I can’t think of a reason to do so at the moment. However, I will be closely monitoring the 1530 zone. If the bulls defend the 1547.92 level and pair reverses, 1564 will be strong intra-day resistance. Beyond that level, more resistance will be found at 1572 and 1585. Today the primary focus will be on the central bank meetings and European Services PMI data. The European Central Bank, Bank of Japan and Bank of England are going to release their latest policy decisions later today.