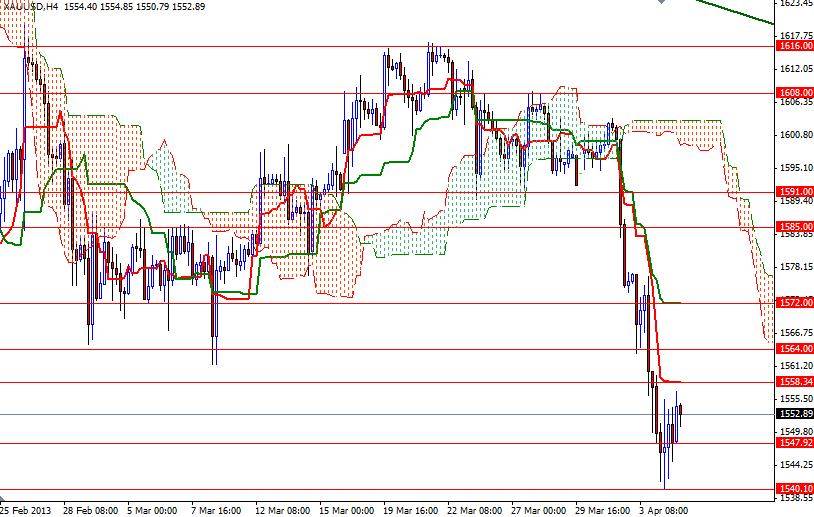

After three consecutive days of losses it appears that the XAU/USD pair steadied during the Asian session today. The pair had continued its bearish free fall yesterday and hit the lowest level since June 31. Although gold recovered some of earlier losses at the end of the day, the bulls seem pretty weak at the moment. In addition to weakening demand for physical gold, comments from some voting members of the Federal Open Market Committee have been causing trouble for the gold bulls. San Francisco Fed President John Williams said “Assuming my economic forecast holds true, I expect we will meet the test for substantial improvement in the outlook for the labor market by this summer. If that happens we could start tapering our purchases then”. Since the Federal Reserve ties future monetary policy to specific unemployment, investors will pay close attention to the U.S. non-farm payrolls data due later today. From a purely technical standpoint, the pair will remain bearish in the near future unless it trades above the 1564 level, which was the previous support. I believe this level is a strategic point for the bulls to conquer, if they are going to stop the bulls' advance. This week's settlement price will be extremely important. The pair continues to trade below the Ichimoku clouds and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses.

If we end the week below 1547.92, it is likely that we will test the 1532/30 zone next week. A close below this zone would mean that 1522, 1487 and 1444 would be the next targets. To the upside, the first challenge will be waiting the bulls at 1558.34. If the bulls manage to break through 1558.34, there will be more resistance at 1564 and 1572.