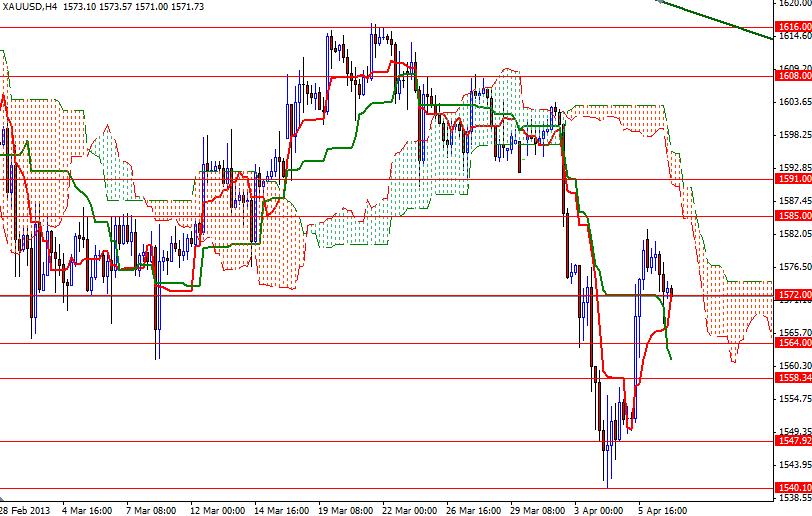

Gold prices (XAU/USD) fell yesterday as the initial rally faded after the bulls run out of steam around the 1585 resistance level. Prices have been bearish during the Asian session today but I will be keeping an eye on the 1572/0 support zone. The main event of the week will be release of the minutes of the Federal Open Market Committee meeting held on March 19-20. The minutes which will be released on Wednesday should provide some useful insight into what the voting members were thinking at that time. Although last Friday’s payroll report showing the U.S. economy created just 88000 jobs in March renewed the concerns that the job market was weaker than it appeared, the major stock markets and the USD/JPY pair continue to grind higher. The daily and weekly charts still suggest that the descending channel will contain the pair on a long term basis.

I believe breaking above the 1616 (the top of the ascending tunnel) and 1626 (the upper line of the Ichimoku cloud) zone is just a dream for the bulls at the moment but it is possible to see a consolidation period between 1585 and 1564 before the next big move. If the bulls manage to defend the 1564 support level, the recent weakness in the American dollar may provide some support for gold. In that case, expect to see resistance at 1585, 1591 and 1608. However, if the bears start to dominate and drag prices below the 1564 support level, I think the 1558.34 support will play a very important role in the value of the shiny metal. A close below this level would indicate that we are heading back to 1532.