By: Johnathan Miller

Ben Bernanke’s comments coupled with the lack of changes to the ECB’s benchmark interest rate last week have seen the Euro climb back from multi-month lows to above the 1.30 handle. Mario Draghi’s comments further reassured shaky markets, fearful of further “Cyprus-esque” bailout scenarios with his comment that “Cyprus is not a template” for future Eurozone bailouts. However, risks to growth prevail and further downside revisions in regional deficit targets clearly displays the suspension of progress as draconian austerity measures choke off any expansion.

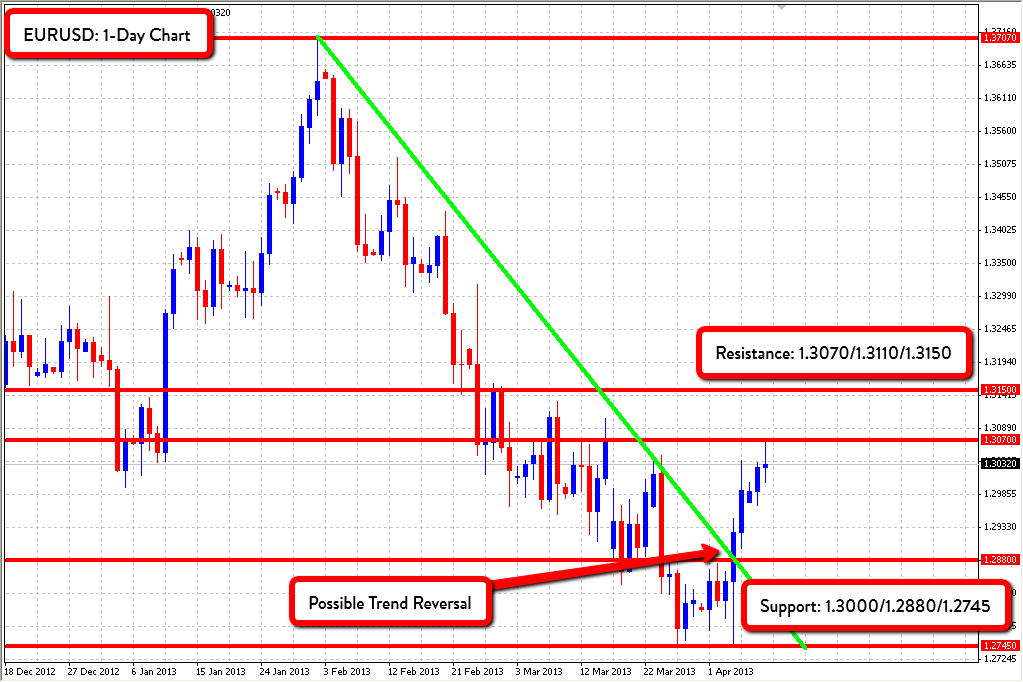

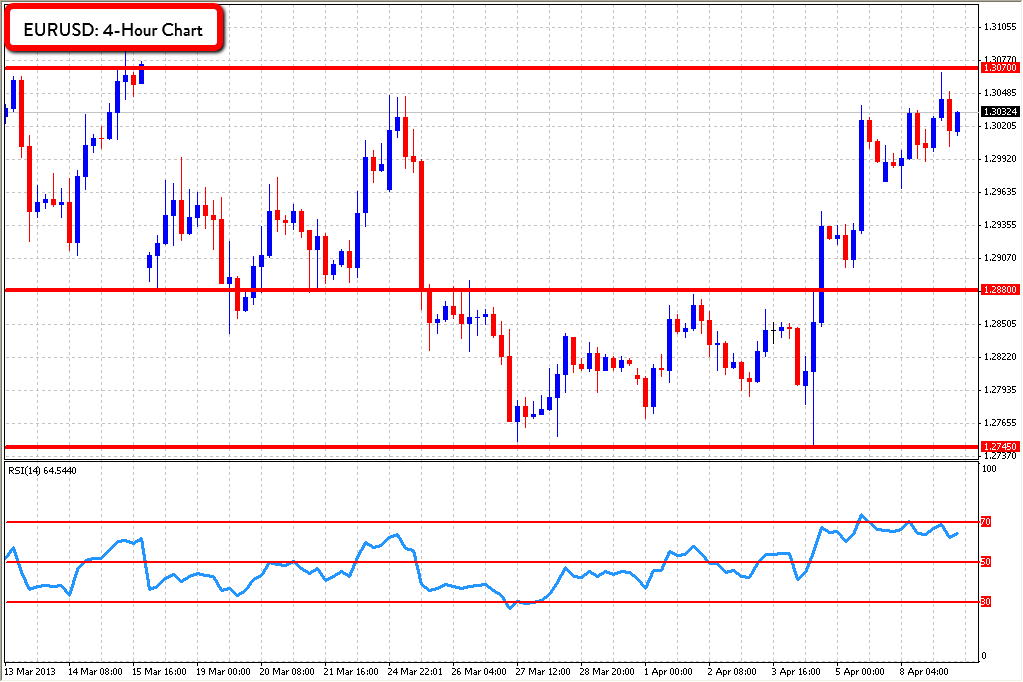

After blowing through the major technical level sitting at 1.3040 and 1.3050 on the stress test remarks from Bernanke to 1.3068, EURUSD has since retreated from levels not seen since March 15th. The surge higher from the lows of 1.2745 shows that the technical rebound and retrace is intact and further confirms that the pullback might have further room to run. Macro risks including the tensions on the Korean Peninsula and further worries stemming from Slovenia could push the pair lower as investors seek haven assets. The climb back above the 200-DMA and persistent weakness highlighted by Bernanke has pushed the pair higher.

Based on the move lower from 1.3700 to 1.2745, the recent pullback of slightly more than 30% shows that the pair is behaving in-line with traditional technical analysis and the retrace could run as high as a 60% pullback or near 1.3350. While longer-term risks to the Euro prevail and the resumption of the EURUSD downtrend is likely if U.S. macro data improves, a near-term rebound might prove inevitable. The major longer-term support levels sit at the 1.30 handle, 1.2880, and 1.2745 in extension to the downside. On the upside, a break of resistance at 1.3070 could see a move towards 1.3110 and long-term pivot level 1.3150.