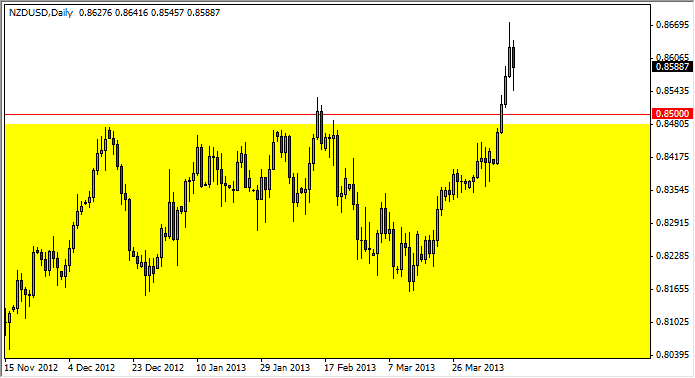

The NZD/USD pair finally broke out of the massive consolidation area that ended at the 0.8550 area during the course of the previous week. On Friday, we saw a bit of a pullback, but also sold bounce from that area as well. This candle formed a hammer, and it does in fact suggest that we will see buying pressure in the New Zealand dollar. This makes quite a bit of sense right now, as the Federal Reserve continues to engage in asset purchases, while the New Zealand housing market is starting to heat up. In fact, there has been chatter out of the Reserve Bank of New Zealand that interest rates may have to come up in order to combat a housing bubble. If that's the case, the Kiwi dollar should continue to strengthen for the longer-term as well.

Because of this and the technical significance of breaking out of a potentially 1000 pip consolidation block, I think this is going to be one of the strongest trades for the next several months, and possibly the entire year. As long as the interest rate differential stays relatively strong, and New Zealand of course has some of the strongest interest rates in the Western world, we should continue to see this market gain over the long run.

Federal Reserve

There will come a time when the Federal Reserve starts to ease its asset purchases, but we are probably several months away from that. However, you have to be aware the fact that when that happens, this pair will experience some sort of pullback. On the whole however, there should be enough of an interest rate differential still that the markets will more than likely view it is a buying opportunity. After all, simply slowing down the rate of asset (read: Treasury Notes) purchases won't raise rates astronomically, at least in theory. With that being the case, I believe that buying the dips in this market for the next several months will be a profitable way to trade it. I can see no reason to sell at all, as it is simply easier to follow the longer-term trend.