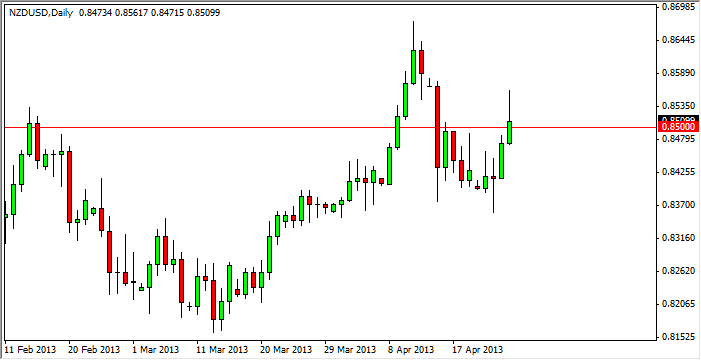

The NZD/USD pair rose during the session on Thursday, breaking above the vital 0.85 resistance area. However, we did see quite a bit of the gains reversed, and eventually printed somewhat of a shooting star like candle. With that being said, I believe that since we are closing above the 0.85 handle that this market will continue higher, but it will be more of a grind and less of a shot straight up.

While this candle is in exactly the shape that I like to see, I have to say that it does look like the resistance has been punctured, and the next 24 hours should be very important for this market. More than likely, the track of the New Zealand dollar will be whether Friday ends up being a "risk on" or a "risk off" type of session. If the markets are happy, we could see this pair head towards the top of the Thursday range.

Massive consolidation breakout

The break above the 0.85 level a couple of weeks ago was actually the breakout of a fairly massive consolidation area that measured 1000 pips. Whether or not that is a false breakout is been figured out right now, but I believe that eventually we will see the answer and it will be relatively easy to tell. If we managed to break the top of the range for Thursday, I fully believe we will see this market make fresh highs, and more than likely head towards the 0.95 handle before it's all said and done. If that's the case, this could be one of the more profitable currency pairs over the course of the rest of the year.

With the lower liquidity in the New Zealand dollar, I prefer to trade this pair over the Australian dollar. While the two tend to move in tandem, this will get a much larger returns and for less margin. Going forward, I believe that the Kiwi dollar will continue to be a favored currency for the immediate future, and quite possibly the rest of 2013, and maybe even 2014.