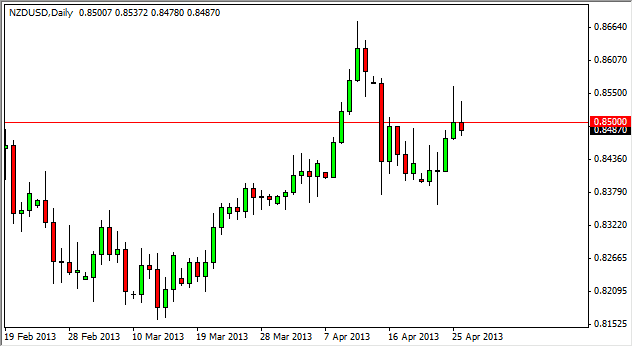

The NZD/USD pair tried to rally during the Friday session, but just as it did on Thursday, it simply could not stay above the 0.85 level. It is because of this that I think we may see some weakness coming in this pair, but I am not necessarily calling for some type of meltdown as the market is most certainly well supported at the moment.

The fact that I see two shooting stars in a row at this vital level certainly makes me believe that we could see a pretty significant pullback. However, I also see quite a bit of support down at the 0.84 level, and as a result we could simply grind away sideways for a while instead. I think that the sideways grind will last for a while, but in reality there are plenty of reasons to think about owning the New Zealand dollar at this moment.

The interest rate differential is of course paramount in this pair, as the New Zealand dollar offers some of the best in terms of interest rates of major currencies at the moment. Also, the New Zealand housing market has picked up quite considerably, and it appears that this market may force the Reserve Bank of New Zealand to raise interest rates in the relatively near future. If that happens, obviously money will go flowing into the Kiwi dollar, and away from just about everything else.

The search for yield

Don't ever forget that the most important thing driving markets is the search for yield. This is essentially what's driving the market at the moment, and as a result investors that are willing to the boy capital around the world look for markets that are stable, and business friendly. This being the case, they need to see yield as well, as the bond market simply are not what they used to be. This is one of the most compelling arguments for the New Zealand dollar as the yield is so much higher there.

Having said all that, I cannot help but think that a pullback is coming. I think that the 0.84 level will offer enough support to keep the market elevated, just as I would think a break of the top of the shooting star from Thursday would be a signal to start buying again. In the end, I do like the New Zealand dollar, but sometimes it's about timing more than anything else. I would of course be willing to buy support down at the 0.84 level if we get it.