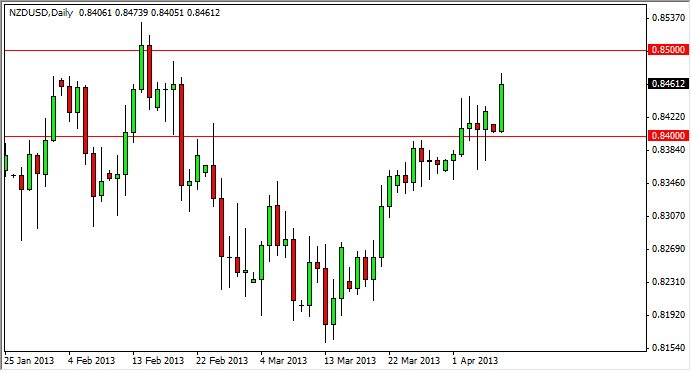

The NZD/USD pair had a strong showing on Monday, using the 0.84 level as a launching pad. While this was bullish enough, I have concerns about the Kiwi dollar at the moment, only because there is so much resistance just above current levels. Ultimately, I do believe that this market eventually breaks out, and above the 0.8525 level I see nothing but blue skies.

Looking at this chart, it's easy to see that the 0.84 level is massive support, especially considering that there were two massive hammers last week. This almost always means that there is going to be strong support, and as a result I certainly wouldn't short this pair. In a lot of ways, this market looks like one that's trying to wind up to breakout, and this of course wouldn't surprise me due to the fact that the Federal Reserve continues to print unlimited stimulus Dollars.

As for selling is concerned, you can see that there are a lot of minor support levels all the way down to the 0.80 level. Because of this, any type of fall in this currency pair will more than likely be choppy at best, and as a result I have no interest in being involved in. Looking at this chart, I think that the path of least resistance is definitely to the upside, so I fully intend to be long of the New Zealand dollar relatively soon.

Massive consolidation

There is a massive consolidation pattern on the longer-term charts that extends from the 0.75 level all the way to the 0.85 level. Because of this, I believe that the 1000 pips will be used as a measuring stick in order to find the final target if we managed to break out. That would have the market going as high as 0.95, which of course seems a bit outrageous at the moment, but when you think about what the Australian dollar has done of the last several years, it's not a real stretch. As for shorting this market, it really can't be done entity get below the 0.80 level.