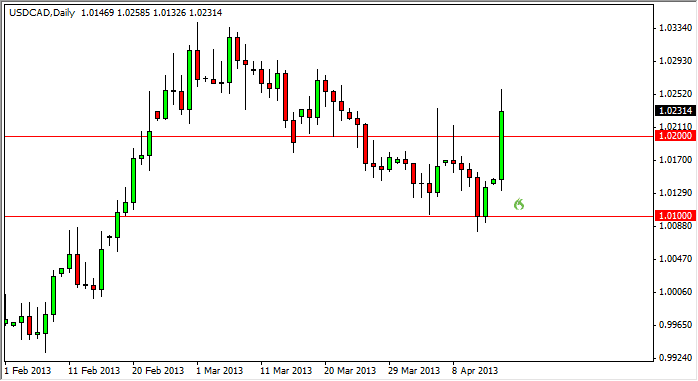

The USD/CAD pair had a bullish session during the Monday trading hours as we finally broke above the 1.02 level solidly. In fact, we managed to break above the 1.0230 area, which was a recent high that I had anticipated being rather resistive. In fact, I have been saying that if we can get above that level, this pair could be bought at that point.

Certainly, the selloff in the oil markets didn't exactly hurt this move either. Monday saw the Light Sweet Crude and the Brent market selloff rather drastically over the course of the day. Given the ferocity of the selloff, it is no surprise to me at all that the Canadian dollar got absolutely pummeled.

Bank of Canada

It probably doesn't hurt that Wednesday was see the Bank of Canada have a monetary policy meeting. It will be interesting to see how the Canadians look at the economic situation right now, as the US economic numbers recently have been a little bit disappointing. Also, the world tends to follow whatever it is the Chinese say they are doing, and with their rather lackluster numbers recently, it'll be interesting to see how the commodity currencies do in general.

I do believe that this market may try to front run the Bank of Canada’s meeting in anticipation of what they may say. Right now, I would have to think that the market expects the BOC to be more dovish than originally anticipated. After all, it was just at the last meeting that the BOC surprise everyone by suggesting that the Canadians will be raising rates much later than anticipated. It wasn't that long ago that people had expected the BOC to be the first of the major central banks to implement a rake hike. Things have changed, and the markets have gotten increasingly skittish. This was especially obvious during Monday, as the gold markets lost over 9% in a single trading day! And then type of environment, it's very likely that the Canadians will choose to be more free with their monetary policy for a bit longer than anticipated. After all, nobody wants to go back into recession, especially if you're Canadian and it’s essentially everybody else's fault. I am a buyer of this pair on a break of the Monday high.