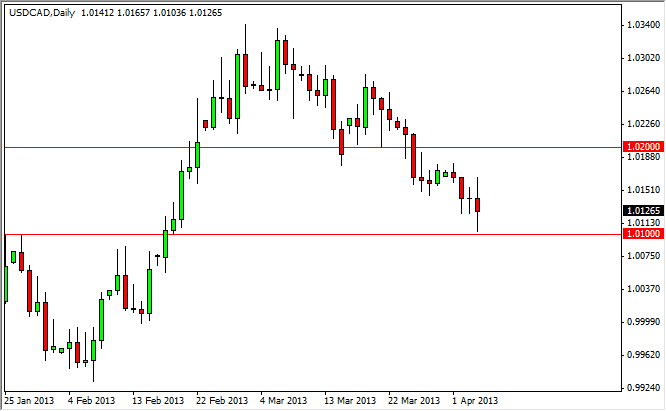

The USD/CAD pair went back and forth during the session on Thursday, as the markets tried to deal with several different central bank announcements at once. Within the shape of this candle, you can see just how neutral the day was. This of course doesn't surprise me though, as the nonfarm payroll number comes out today. This pair is particularly sensitive to that announcement, and as a result I tend to watch the USD/CAD pair more than any other one during that day.

The reasons are obvious if you think about them: both economies are so intertwined that the US employment situation has a drastic effect on both. After all, the Canadians send 85% of their exports to the United States, and if the number one customer of that country isn't working, you're not exporting. With that being the case, it's somewhat counterintuitive but makes sense if you think about long enough that this pair will rally on bad economic news. People delve into the US dollar and away from the Canadian dollar on bad headlines as there will be less demand for Canadian exports.

1.01 is significant

The 1.01 level was the site of a major breakout as you know if you've been reading my articles, and it is an area that I have been watching rather seriously. In fact, if it weren't for the fact that Thursday was the day before nonfarm payroll Friday, I would have gone long of this pair right at the handle. However, with that announcement coming up I decided to play it safe and wait until I see what happens.

If the 1.01 level can hold a support, I think this market will move all the way to 1.04 as we go into the spring. This makes sense of course, as the old expression "sell in May and go away" could come back into play again this year. After all, it's happened over the last three years, and as a result riskier assets such as the Canadian dollar tend to suffer right around the beginning of that month. I'm not calling for some type of meltdown, but I do think this pair should continue higher. However, if we close below the 1.0050 level on the daily chart, I am more than willing to start shorting as it would show a serious breakdown of support.