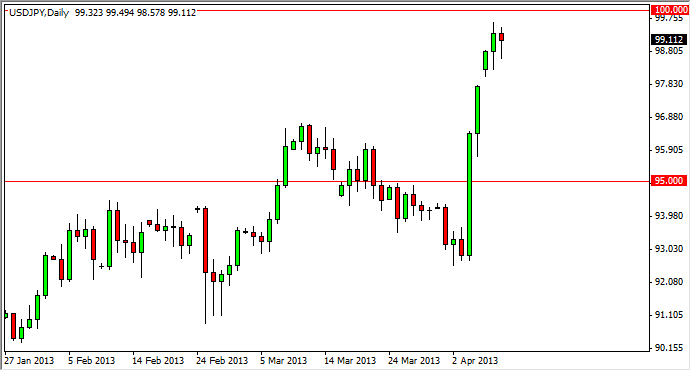

The USD/JPY pair had a fairly weak showing during the Tuesday session, as the 100 level is just above. By the end of the session, we ended the market just above the 99 handle, and had formed a hammer. While this typically implies strength, I believe that this market is getting ready to pull back a bit, and rightfully so. However, I would have to recognize the fact that a move above the 100 handle on a daily close would in fact be significant.

Looking forward, I fully expect this market to break above the 100 handle, but I don't necessarily think it's happening right this second. We could do it obviously, but I think it would be much healthier if the market could pull back to roughly the 98 handle or so before possibly going higher. An alternative move could be to simply go sideways for a while as the yen related pairs tend to do sometimes the market would simply have a chance to catch its breath.

Bank of Japan

This market is by far the most manipulated one that you can be in. Luckily for us, it is manipulated in one direction, up. The Bank of Japan is not going to allow all of its hard work to go against itself, so I have a hard time believing that this market will be able to break down below the 95 handle. In fact, that is the "floor in this market" as far as I can see.

I will be using shorter-term charts to enter on pullbacks though, as I am allowing this market to have a wide stop as I believe this market is in a longer-term a cyclical bull run. The selling of this market is going to be impossible, and even though I can make a case for a market that is overbought, it just isn't worth the risk anymore. By being patient, we simply allow the market to come back to better prices, where we can take advantage of the cheap US dollar. This is by far the easiest way to trade, and without a doubt one of the more profitable.