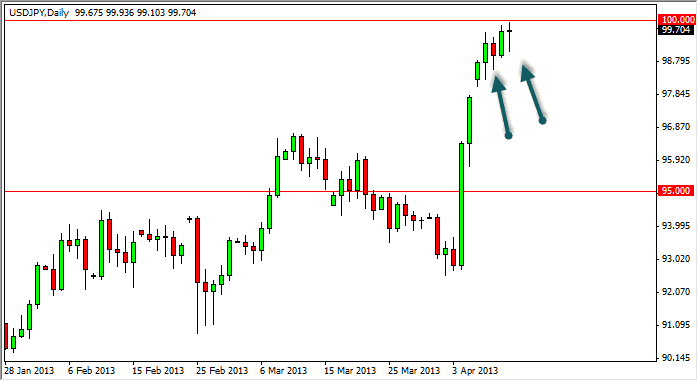

The USD/JPY pair initially fell during the Tuesday session, but got close to the 99 handle and saw a lot of buyers stepped into the marketplace in order to prop it up. This is probably how was pair is going to act in the near-term, simply because the entire world wants to short the Yen, but many of the traders out there would have missed this trade. After all, it's not hard to imagine how they would be very leery of going long after the relatively parabolic move that we had seen over the course of a few short days.

With this in mind, I believe that we will see fire step in every time this pair falls more than about 100 pips. In fact, that's exactly what we saw the market do on Thursday as it tried to break above the 100 level yet again, but failed and then bounced.

100.00

I believe that the 100 handle will be vital for the future of this market. With the fact that we have seen higher lows of the last five sessions even as we slow down, suggests to me that we are seeing immense buying pressure at this point. There almost has to be major option barriers at the 100 handle, and my suspicion is that when we finally break above it, massive amounts of stop loss orders will be triggered, causing this market to skyrocket. It is because of this that I would not be surprised to see this market go sideways for a few sessions.

Needless to say, a breakout above the 100 level has me heavily into the long side of this market. If we can get above that level, I believe that it opens the door to 105 at the very least, and potentially 110 over the course of the next several months. In fact, 110 just happens to be my yearend target in this particular market right now. As for selling this market is concerned, I see aptly no scenario in which I would want to do so as the Bank of Japan will certainly get involved if it starts selling too drastically.