The USD/JPY pair has been a one-way trade for quite some time, and the entire Forex world wants to sell the Japanese yen. This is been a great way to boost your accounts, as the simplicity of this trade has been quite overwhelming. Quite frankly, anybody who is buying Yen from you is either delusional, or has to do it on an outside basis, and in other words trying to convert money for business.

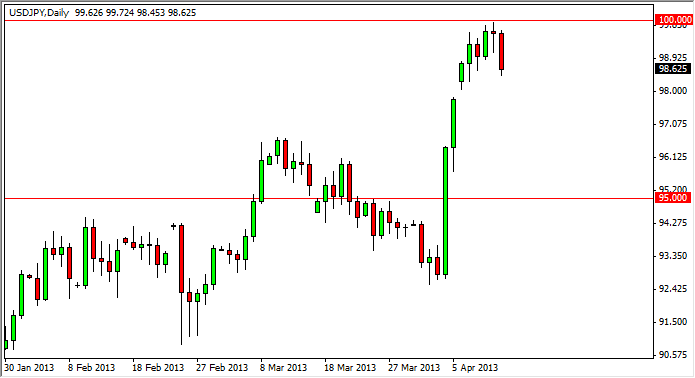

However, even in the most bullish markets you will see pullbacks in time to time. I believe this is what the Friday session was all about. As you can see, the hammer that formed on Thursday was broken below, making it what is known as a "hanging man." This candle stick is one of the more bearish ones out there, and normally leads to a selloff.

However, I am not prepared to start selling this pair, quite the opposite. In fact, I simply see this is a buying opportunity that will be coming up in the next few sessions. Have a hard time believing that this pair is certainly going to melt down, and that the Bank of Japan wouldn’t have something to say about it if it does.

Looking for support

Somewhere below, we will almost certainly see support for this pair. The 100 handle is a large psychologically significant area, so the fact that this parabolic move stalled there really isn't much of a surprise. On top of that, I would have to believe that there are a lot of option barriers above that level, and as a result it will take something fairly significant to break out of it. However, it isn't much to think that perhaps the 97 level would be supportive, as I can see that was the previous high.

I will also pay attention to various handles all the way down, as the 98 handle has a small gap added that could actually be supportive as well. And then there is the 95 level, an area that is very obvious, and as a result I believe that the entire market would be willing to buy at that point as well. It's just now a matter of simply waiting to see what the market offers us. Alternately, if we managed to break above the 100 handle on a daily close, we may just simply go parabolic again.