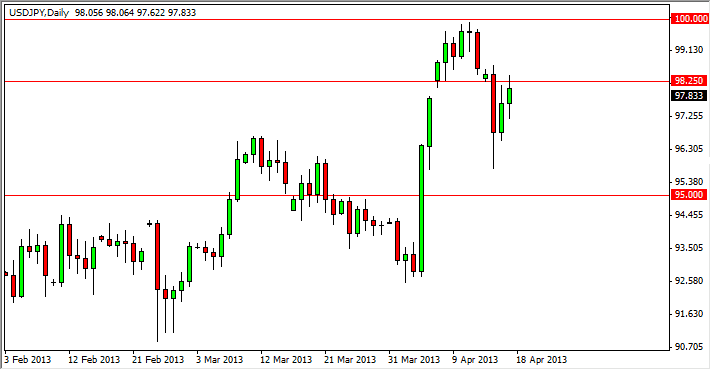

The USD/JPY pair of positive session on Wednesday, but failed to break above the 98.25 level. This area has been support recently, and as a result it was expected to be resistant. In fact, it has acted as such, and as a result the candle couldn't quite break above it and hold for any length of time.

However, having said that the Bank of Japan is still heavily involved in depreciating the value of the Yen over the long-term, and I do believe that eventually we will break over the 98.25 level. In fact, I think it will happen much quicker than most people realize, and the next thing you know we'll be talking about whether or not we can break above the 100 level again.

The Japanese have basically stated that no matter what it takes they are going to devalue the Yen. There is a G 20 meeting later this week, but quite frankly I don't think the Japanese care about that. While the rest the world's financial ministers talk about how currency rates need to be freely floated, the Japanese will more than likely be buying more JGB’s. It is absolute folly to think that some international body can tell particular country is held two handle a currency, when most of the major players in that international body do exactly the same thing. Honestly, can you tell me that you don't think that the Federal Reserve manipulates the value of the US dollar?

100 will be the real fight

I still think the 100 is the real fight in this marketplace, and that will be fairly epic. We will eventually get through it, but it will take quite a bit of bullishness. As long as there are headline risks out there, there's always the chance that we do get a pullback as people run back into the Yen, but these will be short-term moves at best. With that being the case, I think that every time this pair dips, it's an invitation to start buying again. As for selling, it simply can’t be done.