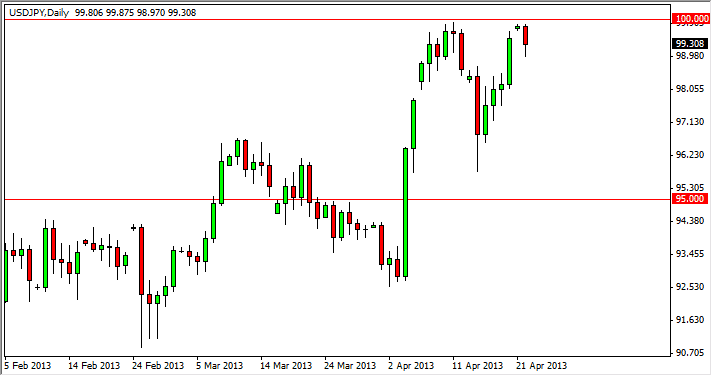

The USD/JPY pair fell during the session on Monday, as the 100 handle proves to be far too resistant yet again. I have been talking to several people in the industry, and many of them seem to be of the opinion that there must be a large options barrier just above us. This would make sense, as 100 is certainly a common strike price, and it would also explain why we simply cannot break it.

However, options expire. And if that's the case, there will come a point time where the barrier disappears. Once that happens, this market should continue much higher. In fact, I fully expect to see 110 by the end of the year. The way this is been going, we may see 110 by the end of the summer.

Ultimately, some of the most bullish analysts on the Forex markets have suggested that this pair will eventually hit the 120 level. I have absolutely no qualms saying that myself. In fact, I think we will eventually go much higher than that. After all, the central banks need inflation, and the Japanese needed more than anybody else. Also, this pair does tend to rise in times of economic happiness, and that's exactly what the central banks are trying to replicate right now.

Pullbacks are buying opportunities.

And I still believe that any time we see pullback in this pair, it will be a buying opportunity. There simply far too many reasons for this pair to continue higher, not the least of which is the fact that the Bank of Japan is being aggressive in its quantitative easing, and the fact that the G 20 recently has said that they are perfectly fine with that. In other words, none of the other central banks are going to get in their way.

Going forward, I fully expect to buy supportive candles below where we trade right now, and would not hesitate to buy a daily close above the 100 handle. I think this is a one-way trade, so obviously selling isn't even a thought at this point.