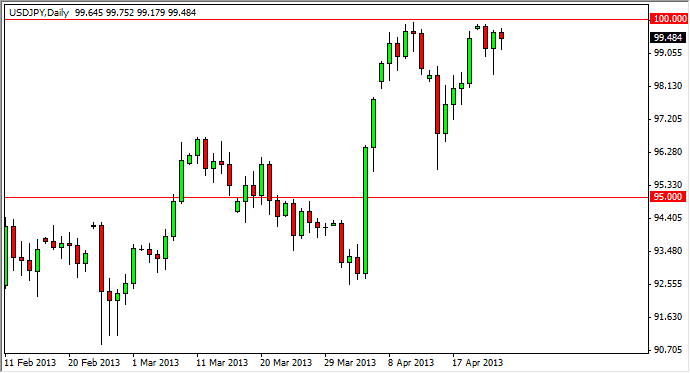

The USD/JPY pair fell during most of the session on Wednesday, but managed to form a bit of a hammer for the session. While the candle itself isn't that impressive, the fact that it formed just after a massive hammer on Tuesday is what caught my attention. I still see the 100 level as vital, and as a result this candle caught my attention for the Wednesday session. This just looks like a market that is trying to breakout to the upside, and you can feel the tension form.

Several of the people that I talk to in the Forex world have suggested that they are hearing about large options barriers just above the 100 handle. If that's true, and it probably is based upon the fact that it is a natural place where you would see options, there will come a time when those options expire and nobody cares. If that happens, this market should just rocket through the 100 handle.

However, that level could get broken between now and then anyway. I still see this as a market that will breakout over the 100 handle, and it's only a matter of time. However, I do recognize that we've seen this market get jittery from time to time, and as a result I am buying on a daily close above that 100 handle, and not before.

Bank of Japan still matters

The Bank of Japan is still in the spotlight when it comes to this pair. In fact, they've barely done anything at this point, and the market has gone running. I believe the Bank of Japan when they suggest that they are willing to do whatever it takes to increase inflation to 2%, and as a result I think this pair will continue higher for a very long time. In fact, the trend is most certainly up at this point.

That being the case, I like buying this pair on dips, and most certainly in a breakout above the 100 handle. There is aptly no scenario where I see selling this pair is been a viable trade, and believe that this will behave much like the carry trade back in 2005 when people simply bought this pair every time it fell.