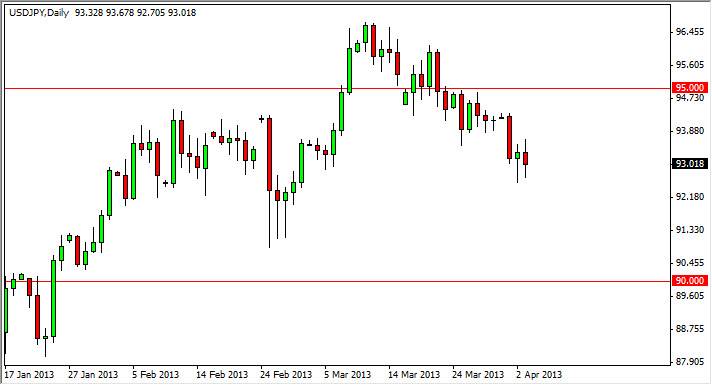

The USD/JPY pair went back and forth during the session on Wednesday, eventually settling for a small loss. This candle did in fact break the top of the hammer from the Tuesday session, so technically it was a buy signal. With the fact that the Bank of Japan is meeting this morning, this pair could get very interesting, very quickly.

With that being the case, we will finally start to hear more plans out of the Bank of Japan as to what they choose to do with their monetary policy. We know that they will be easing monetary policy, now the question becomes how much and how long? I suspect that the Japanese are going to come out with something along the lines of a nuclear weapon, and now it comes down to whether or not the market has priced this in.

There is the possibility that the market gets disappointed however. If that's the case, I believe that this pair will selloff, but eventually will provide an even better buying opportunity as the 90 handle will certainly be some kind of a "line in the sand" when it comes to the tolerance of the Bank of Japan.

Monetary policy announcement

The price action this morning will be volatile, but in reality I see no way to actually by the Yen. Because of this, I simply cannot short this pair under any circumstances as I will be fighting a central bank in the process if I do it. Alternately, I think that the pair does go higher and eventually reaches towards the 100 handle. It won't necessarily be today, but I do believe this is where we go over the longer term.

Looking at the technical analysis of this chart, the hammer that formed during the Tuesday session would have been at roughly the perfect spot, so I'm still bullish of this pair. Just be aware of the Bank of Japan, and the announcement that's coming today. If this pair sells off and stays above the 90 handle, which I fully believe it should, I will be adding to my already long positions.