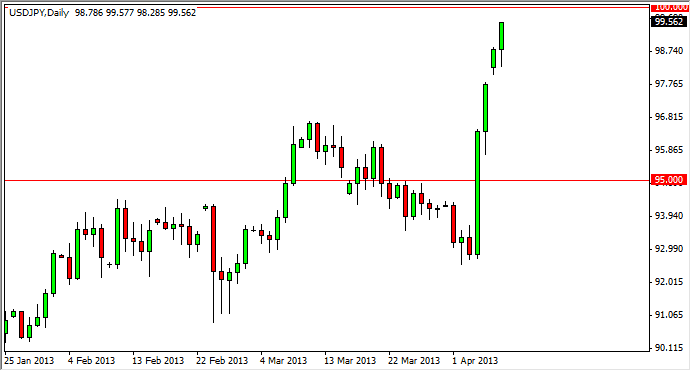

The USD/JPY pair rose yet again during the session on Monday, and even managed to close of the very highs for the session. This market is obviously heading towards the 100 level, an area that I've been calling for some time now. However, in my wildest dreams I would've never expected to see it happen in a few short sessions.

That being the case, I have to think that the market will start to slow down relatively soon. After all, we can keep going and this parabolic push at this rate. However, I am where the fact that if we break the 100 handle, it could very well into been support going forward. In fact, that's the base case that I have at the moment, but I expect to see this much further down the road.

When you get to an area like this, there are three possibilities: you may be able to go straight through the resistance area like it wasn't even there, you might see the market simply stop in the general vicinity and go sideways, or you might see some type of corrective pullback. As to which of these three things are going to happen, I would suspect it's one of the latter two. With that being the case, I fully expect to see buying opportunities in this market fairly soon again.

Bank of Japan

While this pair traditionally has a "risk on" type of feel to it when it goes higher, remember this has nothing to do with what's going on at the moment. This is simply the Bank of Japan try to kill off its own currency, and the world reacting. We saw something like this back in 1995, and the Bank of Japan did eventually get what it wanted. I don't see any reason why that will be the case this time around, and as a result I believe that shorting the Yen, or and other words buying this pair, will be the trade going forward for the next several years. I will not short this pair, but I will be more than interested in buying supportive candles every time we pullback.