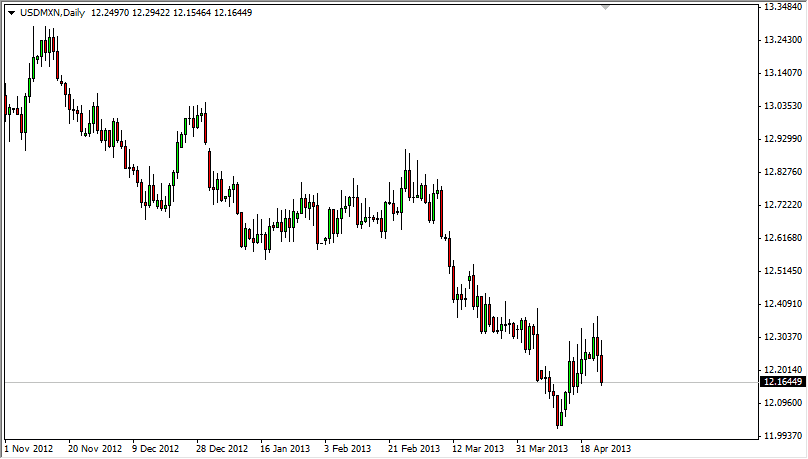

The other day, I mentioned this pair in my analysis and told many of you that I thought it would start falling again. It has certainly done just that, and it also has done it in congruence with the rising of oil prices. This makes sense, as the Mexican peso is certainly time to the price of oil. While many people know that the Americans by quite a bit of crude from the Canadians, it's less known that there is a huge market for the Americans in buying crude from the Mexicans as well. The Peso will rise and fall with the oil markets over time, as well as bullishness in the US economy.

The Mexicans send a massive amount of their exports into the United States, and therefore needs a strong partner in that country in order to drive demand for its products. In fact, this pair typically will fall right along with the USD/CAD pair, as they do have very similar fundamental drivers.

Looking at the candle for the Wednesday session, you can definitely see that we fell a significant amount for the session, and it does now look like we're going to head down towards the 12.0000 level before it's all said and done. There is also a positive swap for shorting this pair, as the Mexican peso has a nice large interest rate with it.

Don't fight the trend

One of the easiest things for Forex traders tell you is to simply "don't fight the trend." However, sometimes that is the only advice you need. In this pair that deftly seems to be the case, and we are most certainly trading with the trend of we are shorting it. After all, look at all of this noise that you would have to chew through on the way of if you were to start buying. With that in mind, I feel that if we managed to break down below the lows from the Wednesday session, selling orders will more than likely get fired off the session again. On top of all else it seems to be quite a bit of a "risk on" trade setting up in several different currency markets right now, which shorting this pair deftly would line up with.