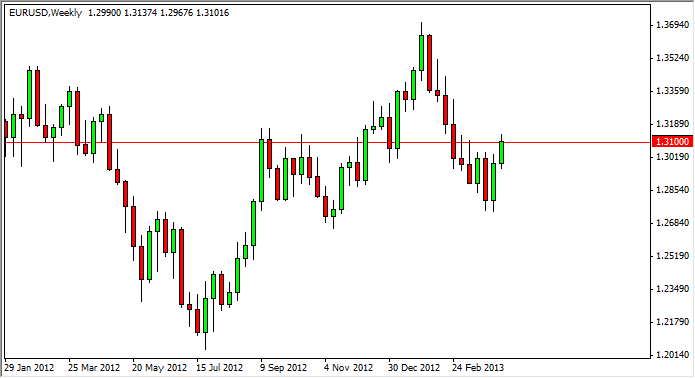

EUR/USD

The EUR/USD pair had a positive week over the last five sessions, essentially breaking up to the 1.31 level. The area did provide enough resistance to push prices back, but in the end it looks as if this pair is going to breakout. The Friday candle ended up being a hammer at the 1.31 level, so I believe that higher prices are in the works. However, I think that the top of the bullish move will be somewhere near the 1.3350 level in the near-term. Quite frankly, if it weren’t for the Federal Reserve and its monetary policy – this pair would be somewhere closer to the 1.20 level.

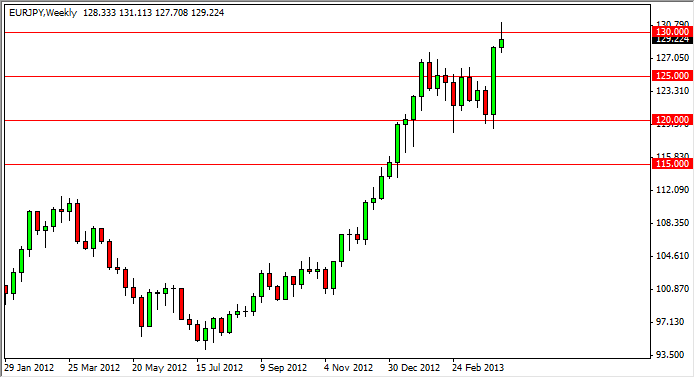

EUR/JPY

The EUR/JPY Pair has been out of control for some time now. The pairs have seen a range of over 1,200 pips in the last two weeks, and has been parabolic several times. This pair finally formed a shooting star at the 130 level this week, and looks ready for a pullback. Quite frankly, this is something that is needed. There are a lot of traders out there that have missed this move, and want in. This pullback will give them that chance, and I will be looking for a supportive candle on the daily time frame in order to reenter on the long side. Selling isn’t even a thought at this point.

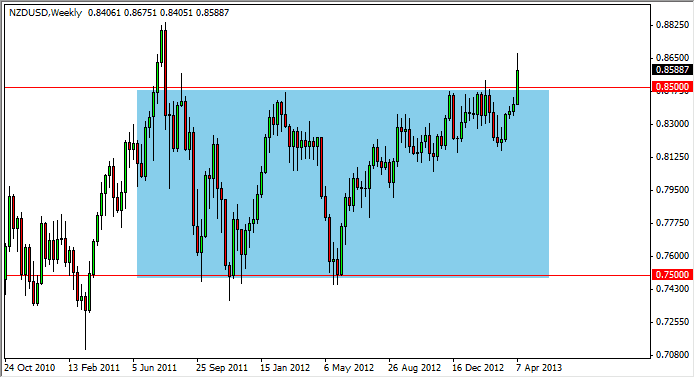

NZD/USD

The NZD/USD pair has finally broken out above the 0.85 level. This is an area that I have been watching for some time now, and this move should lead to a massive move higher over the longer-term. There are compelling technical reasons, but there are also compelling fundamental reasons – making for a nice set up in my opinion. This past week, the RBNZ suggested that an overheating housing market in New Zealand may need higher interest rates. This is certainly a stark contrast to the Federal Reserve. If there is any trade that makes sense at the moment – it’s to buy the Kiwi Dollar.

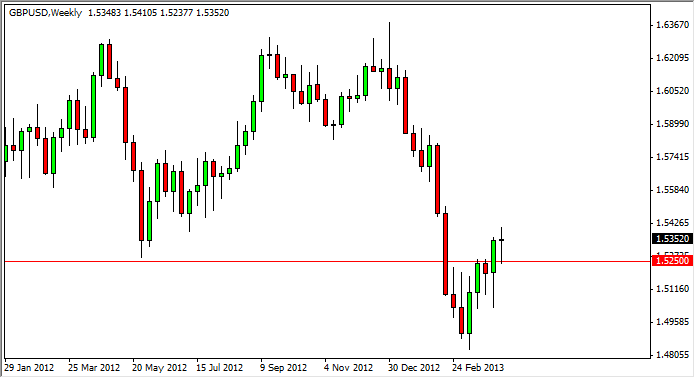

GBP/USD

The GBP/USD pair has made a relatively strong showing of itself lately, and as a result we find the market sitting on top of the 1.5250 resistance line. This area was a support area previously, and as a result it now looks like it will allow the market to make a serious attempt at the 1.55 level. With that being the case, I expect to see the Pound strengthen over the next couple of weeks. If we manage to close below the bottom of this week’s hammer, I would be a seller at that point.