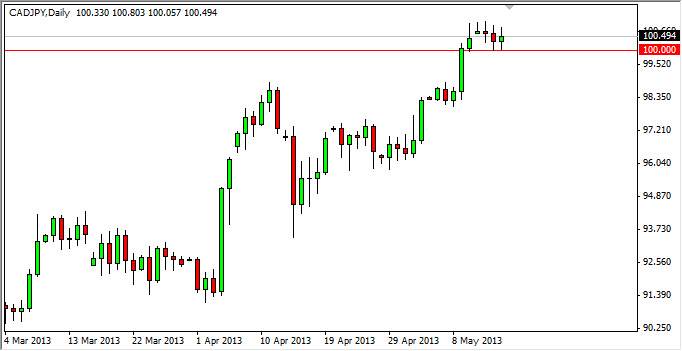

The CAD/JPY pair had a back and forth session during the Wednesday trading hours, testing the 100 handle yet again. This market looks like one that has recently broken out of an ascending triangle, and as a result should continue to see bullishness going forward. The 100 handle acting as support isn't much of a surprise, after all it's probably the biggest round psychologically significant number on the chart.

One thing that most people don't understand about this pair is that it's a proxy for the oil markets. This is because Japan imports 100% of its oil, while Canada of course is a large exporter. As oil prices go, so does this market. With that being said, a weakening Yen should continue to push his market higher as long as we still have reasonable oil demand out there.

Watch the Light Sweet Crude and Brent markets.

You really should be watching both of these markets to get a bit of a "heads up" in this currency pair, but in reality the more important of the two markets is the Light Sweet Crude market. This is because Canada produces more of that than anything resembling Brent. That being the case, it is a better read on the Canadian economy as well as oil demand.

Going forward, and break above the 101 level would smash the top of a couple of shooting stars, as well as clear the top of this doji, making it a very strong buy signal. In fact, that is exactly what I am using in order to start buying this market. I also think that the 99 handle would offer significant support as well as it was once the top of an ascending triangle. Based upon the ascending triangle, we expect to see a move to the 105 level over the course of the intermediate term.

This market obviously cannot be sold, as is the case with almost every yen related pair. The Bank of Japan still works against the value of the Yen, and oil prices are somewhat buoyant at the moment so of course this will be bullish as well for the currency pair.