By: DailyFore.com

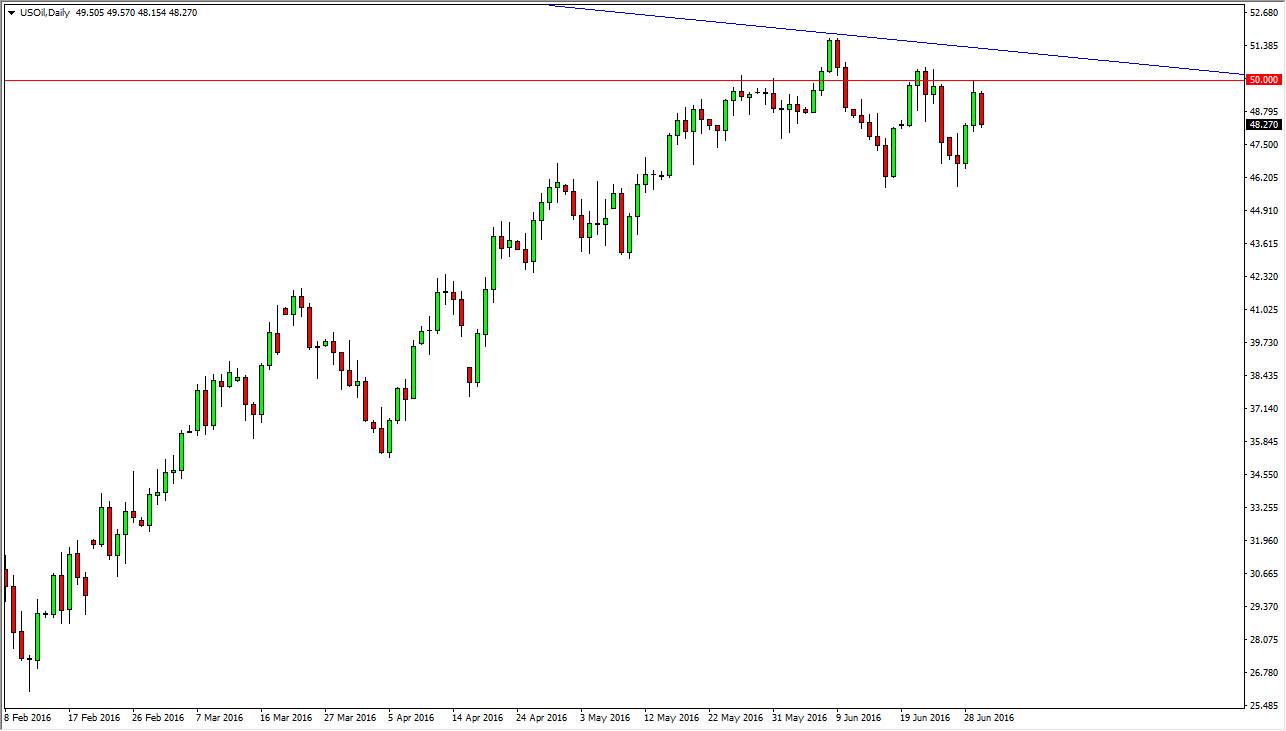

The WTI market fell during the Monday session, closing just below the $95.00 handle. This market looks like it's trying to find some type of support in the $94.00 area, and as a result I think that we will see fairly tight trading over the next couple of sessions. In the long run, this could be a different story but we should see some type of consolidation in this general vicinity.

Looking forward, I think that this market will actually start to fall again, as we are closer to the top of what I see as the overall range than the bottom. However, it is going to be a difficult market to short and hang onto as I would fully expect a ton of noise going all the way down to the $90.00 level. Also, there is always the potential of something crossing the newswires that will spook the markets involving the Middle East over the summer, but I think in general we are starting to find that "summer range" that this market is commonly going year after year.

Great care is needed

Right now, there is much more oil in the marketplace than is needed. Simply put, suppliers outstripping demand. However, the other possible headwinds for the value of oil going forward comes out of the currency markets. At the moment, the US dollar looks very strong, and that could continue going higher going forward. Both of these things should continue to weigh upon the price of oil overall, not to mention the fact that I see a significant amount of resistance above at the $98.00 handle, and while that is a significant distance from here, it is still closer than the $90.00 handle which I see as overly supportive.

All things being equal, I will be looking at this market from a short-term trader’s standpoint, and will not be trying to hang onto anything for any length of time. For the most part, I believe that this market will be very, very choppy over the course of the next couple of months, and will be better suited for day trading than anything else.