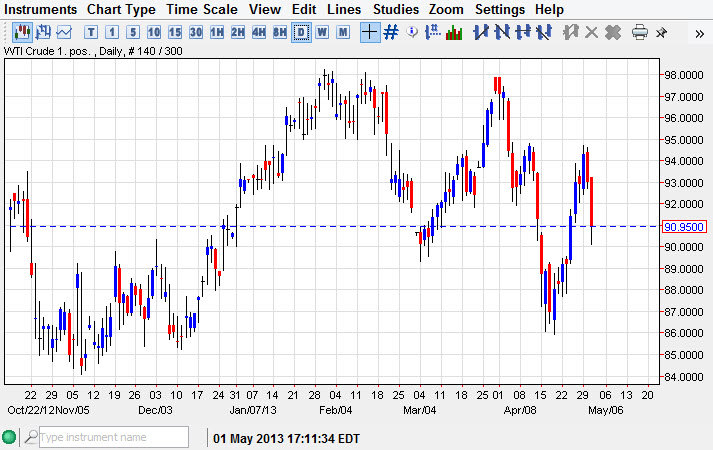

The WTI markets fell during the session on Wednesday, as the inventory number in the United States came out much larger than expected. This of course affects the whole supply and demand equation when it comes to this market, and as a result it's not surprising to see this market fall.

However, the $90.00 level did in fact offer enough support in order to make the market bounce from there. Nonetheless, this candle looks very bearish and I believe that it is only a matter time before we break down below the $90.00 level, and possibly drift all the way down to $87.00. This will become a short-term trader’s type of marketplace now, as it will be difficult to find longer-term signals in my opinion.

Short term charts

I will be looking at this market from a short-term perspective for the next few Dollars when it comes to trading. I believe that the shorter-term charts will offer selling opportunities on rallies, as the bullishness subsides. This is significant of a move directly after a rally certainly would have a lot of buyers concerned at this point in time, and knock some of the bullishness out of their attitudes I would think.

Going forward, I think that we will see continued weakness, and the fact that the US oil inventory numbers were so bearish, one has to start to ask how the economy is really doing. This could have ramifications through several different marketplaces, not just this one and as a result I think the next couple of weeks will be very interesting. We are getting close to that time of the year where a lot of traders will simply "Sell in May, and go away." With that being said, it wouldn't surprise me to see a lot of bullishness simply gets wiped away in the marketplace.

As far as buying is concerned, I am not interested anymore as I think this market has found a temporary top at the $95.00 level, and we certainly have quite a bit of selling pressure between here and there. The US Dollar should be watched as well; as if it carries strength going forward will certainly work against the value of oil simultaneously.