By: DailyForex.com

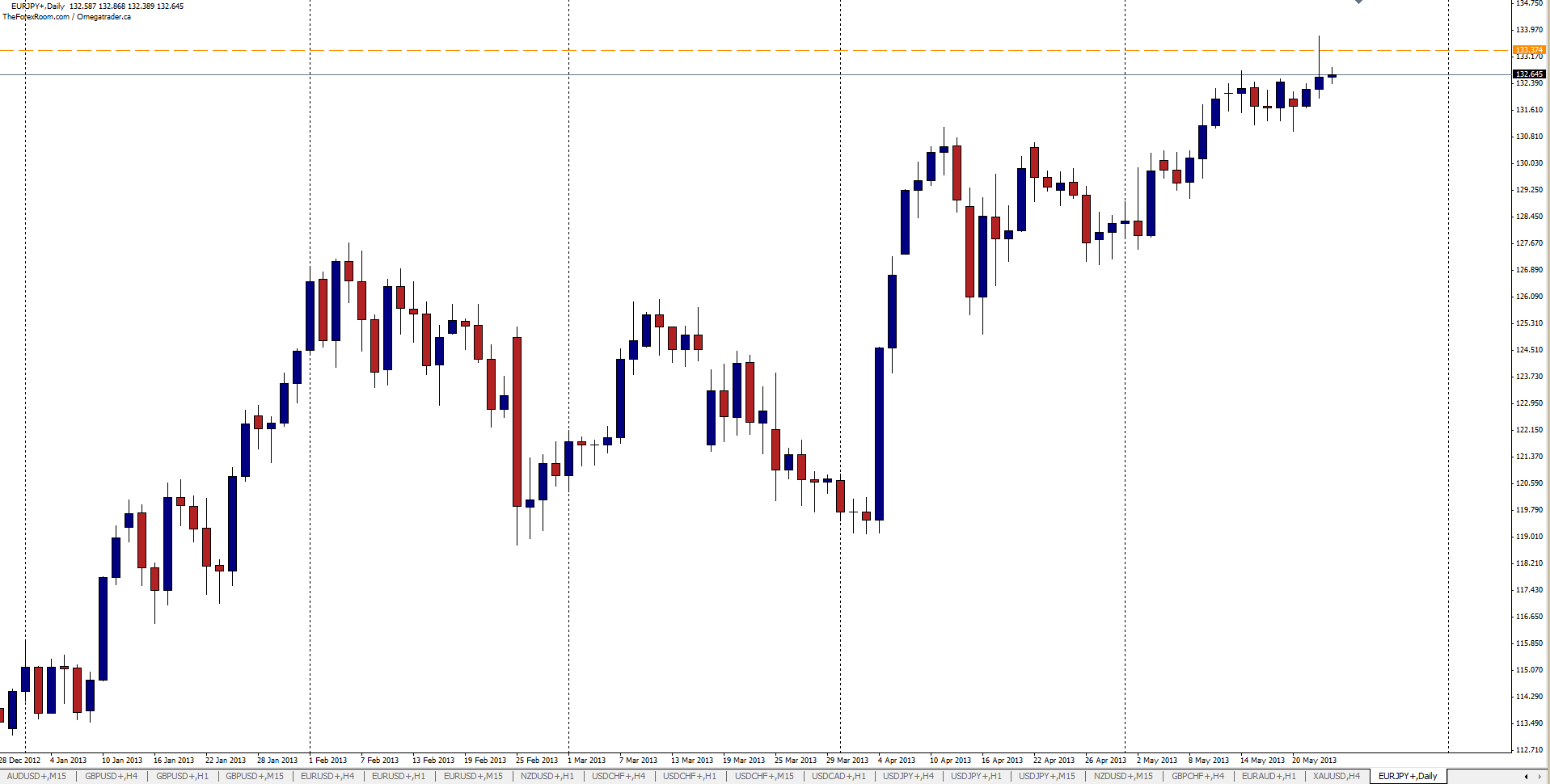

The EUR/JPY reached as high as 133.80 in yesterday’s trading, but could not hold the level with strong resistance at 133.50 from the Monthly Charts. 133.50 has been a turning point for the pair many times as far back as 1996. Since the open of today’s trading, the pair has fallen 123 pips and is trading at time of writing at 131.63 with little sign of slowing down, at least while the Asian markets continue to tumble. The Nikkei is down over 4.5%, easily the biggest one day tumble in the past 8 months if not longer.

There is a strong possibility that this pair will extend its bearish run down to the 130.00 mark by the end of the trading day where April’s highs were established. The next likely target for the days to come will be the 50% FIBO level and January/February highs around 126.50 but any lower and one would expect the BOJ to step in again. Should the Bulls apply the brakes and send the bears packing the most immediate resistance is yesterday’s lows at 131.96, 133.00 and again 134.00.